Question: Suppose that as part of a stack hedging strategy, you enter a short position of one unit in a forward contract that will need

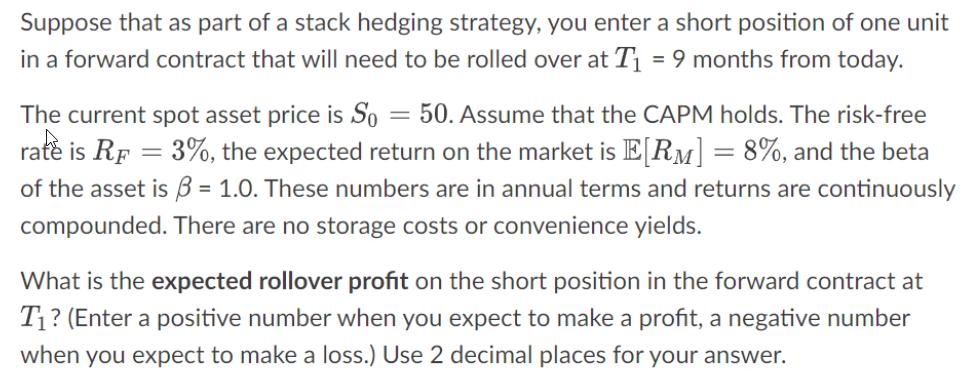

Suppose that as part of a stack hedging strategy, you enter a short position of one unit in a forward contract that will need to be rolled over at T = 9 months from today. The current spot asset price is So 50. Assume that the CAPM holds. The risk-free rate is RF 3%, the expected return on the market is E[RM] = 8%, and the beta of the asset is = 1.0. These numbers are in annual terms and returns are continuously compounded. There are no storage costs or convenience yields. = = What is the expected rollover profit on the short position in the forward contract at T? (Enter a positive number when you expect to make a profit, a negative number when you expect to make a loss.) Use 2 decimal places for your answer.

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

To calculate the expected rollover profit on the short position in the forward contract at T1 we nee... View full answer

Get step-by-step solutions from verified subject matter experts