Question: Suppose that for calculation purpose we only have the three tables of values obtained above, calculate the following by making use of at least one

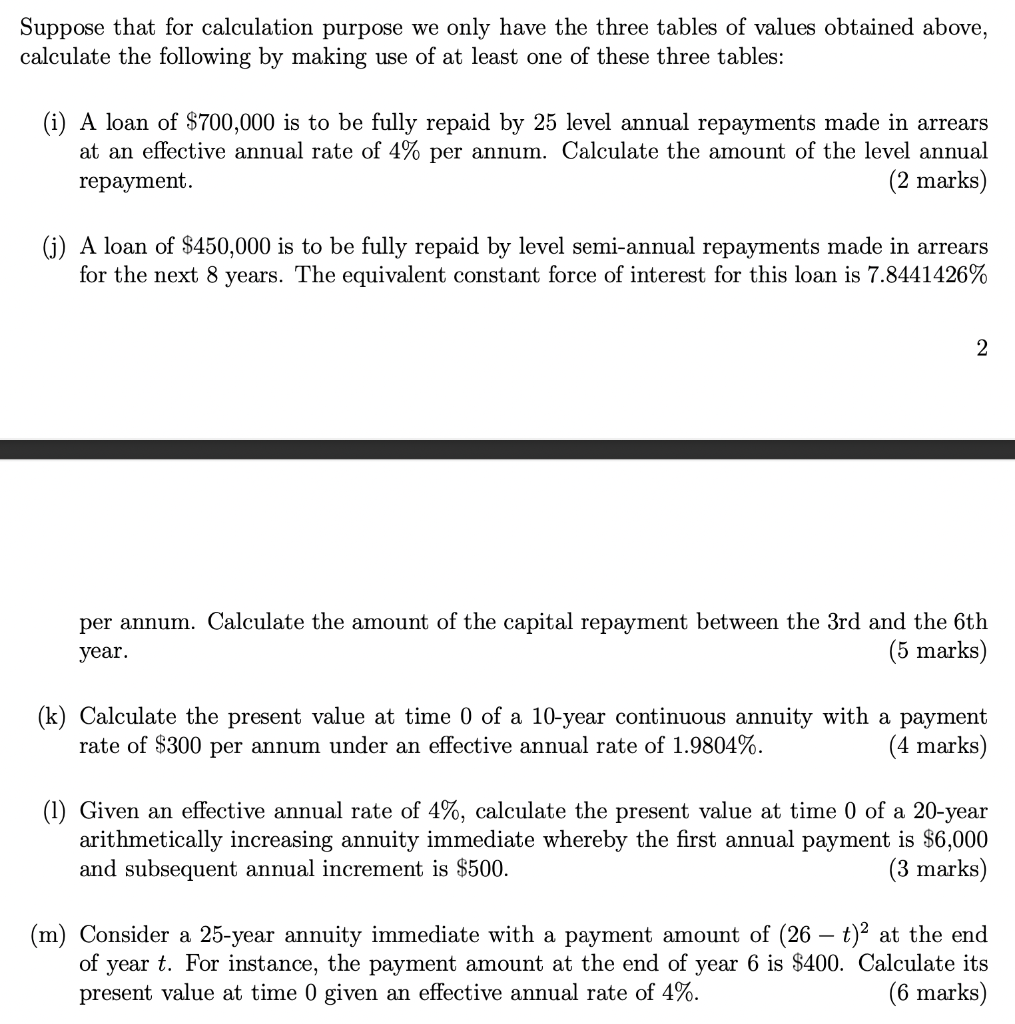

Suppose that for calculation purpose we only have the three tables of values obtained above, calculate the following by making use of at least one of these three tables: (i) A loan of $700,000 is to be fully repaid by 25 level annual repayments made in arrears at an effective annual rate of 4% per annum. Calculate the amount of the level annual repayment. (2 marks) (j) A loan of $450,000 is to be fully repaid by level semi-annual repayments made in arrears for the next 8 years. The equivalent constant force of interest for this loan is 7.8441426% 2 per annum. Calculate the amount of the capital repayment between the 3rd and the 6th year. (5 marks) (k) Calculate the present value at time 0 of a 10-year continuous annuity with a payment rate of $300 per annum under an effective annual rate of 1.9804%. (4 marks) (1) Given an effective annual rate of 4%, calculate the present value at time 0 of a 20-year arithmetically increasing annuity immediate whereby the first annual payment is $6,000 and subsequent annual increment is $500. (3 marks) (m) Consider a 25-year annuity immediate with a payment amount of (26 t)2 at the end of year t. For instance, the payment amount at the end of year 6 is $400. Calculate its present value at time given an effective annual rate of 4%. (6 marks) Suppose that for calculation purpose we only have the three tables of values obtained above, calculate the following by making use of at least one of these three tables: (i) A loan of $700,000 is to be fully repaid by 25 level annual repayments made in arrears at an effective annual rate of 4% per annum. Calculate the amount of the level annual repayment. (2 marks) (j) A loan of $450,000 is to be fully repaid by level semi-annual repayments made in arrears for the next 8 years. The equivalent constant force of interest for this loan is 7.8441426% 2 per annum. Calculate the amount of the capital repayment between the 3rd and the 6th year. (5 marks) (k) Calculate the present value at time 0 of a 10-year continuous annuity with a payment rate of $300 per annum under an effective annual rate of 1.9804%. (4 marks) (1) Given an effective annual rate of 4%, calculate the present value at time 0 of a 20-year arithmetically increasing annuity immediate whereby the first annual payment is $6,000 and subsequent annual increment is $500. (3 marks) (m) Consider a 25-year annuity immediate with a payment amount of (26 t)2 at the end of year t. For instance, the payment amount at the end of year 6 is $400. Calculate its present value at time given an effective annual rate of 4%. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts