Question: Suppose that Goodwin Co, a U.S, based MNC, knows that it will receive 200,000 pounds in one vear, It is considering a currency put option

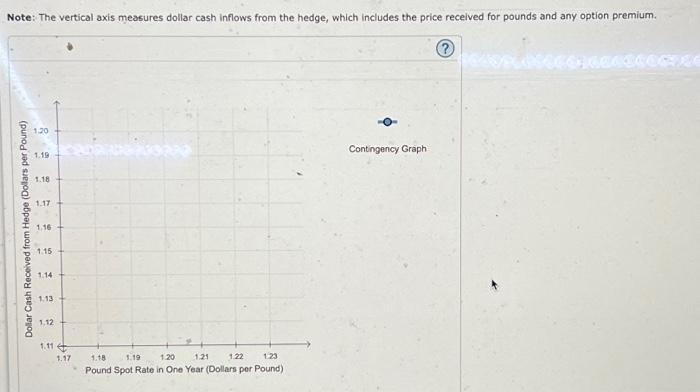

Suppose that Goodwin Co, a U.S, based MNC, knows that it will receive 200,000 pounds in one vear, It is considering a currency put option to hedge this recelvable. Currency put options on the pound with explration dates in one year currently have an exercise price of $1.20 and a premium of $0.04. On the following graph, use the blue points (circle symbols) to plot the contingency graph for hedging this receivable with a put option, Plot the points from left to right in the order you would like them to appear. Line segments will connect automatically, Plot the 3 blue points for the following pound spot rates: $1.17,$1.20,$1.24. Note: The vertical axis measures dollar cash inflows from the hedge, which includes the price received for pounds and any option premium. Note: The vertical axis measures dollar cash inflows from the hedge, which includes the price received for pounds and any option premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts