Question: Suppose that Goodwin Co., a U.S. based MNC, knows that it will receive 300,000 pounds in one year. It is considering a currency put option

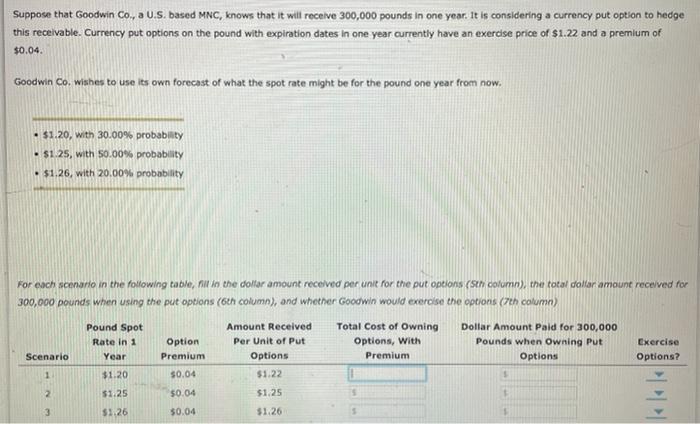

Suppose that Goodwin Co., a U.S. based MNC, knows that it will receive 300,000 pounds in one year. It is considering a currency put option to hedge this receivable. Currency put options on the pound with expiration dates in one year currently have an exercise price of $1.22 and a premium of $0.04. Goodwin Co. wishes to use its own forecast of what the spot rate might be for the pound one year from now. $1.20, with 30.00% probability $1.25, with 50.00% probability $1.26, with 20.00% probability For each scenario in the following table, fill in the dollar amount received per unit for the put options (Sth column), the total dollar amount received for 300,000 pounds when using the put options (6th column), and whether Goodwin would exercise the options (7th column) Pound Spot Amount Received Total Cost of Owning Dollar Amount Paid for 300,000 Rate in 1 Option Per Unit of Put Options, with Pounds when Owning Put Exercise Scenario Year Premium Options Premium Options Options? $1.20 $0.04 $1.22 $1.25 $1.25 $0.04 30.04 $1.26 $1.26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts