Question: Suppose that someone asked you to make a feasibility study of an investment project that lasts two years and requires an initial investment of

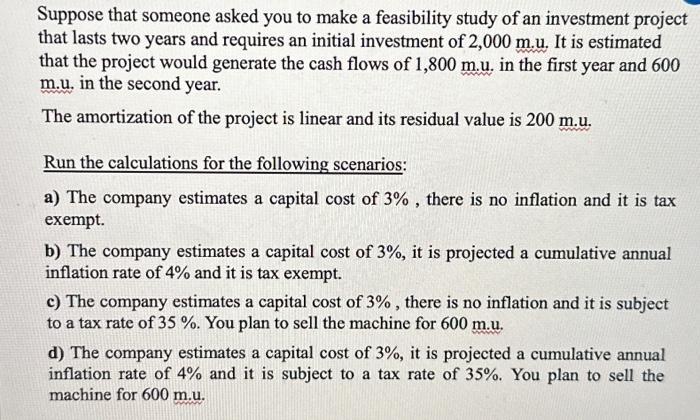

Suppose that someone asked you to make a feasibility study of an investment project that lasts two years and requires an initial investment of 2,000 m.u. It is estimated that the project would generate the cash flows of 1,800 m.u. in the first; year and 600 m.u. in the second year. The amortization of the project is linear and its residual value is 200 m.u. Run the calculations for the following scenarios: a) The company estimates a capital cost of 3%, there is no inflation and it is tax exempt. b) The company estimates a capital cost of 3%, it is projected a cumulative annual inflation rate of 4% and it is tax exempt. c) The company estimates a capital cost of 3%, there is no inflation and it is subject to a tax rate of 35 %. You plan to sell the machine for 600 m.u. d) The company estimates a capital cost of 3%, it is projected a cumulative annual inflation rate of 4% and it is subject to a tax rate of 35%. You plan to sell the machine for 600 m.u.

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

The image displays text describing an investment project scenario where someone is asked to run calculations for different conditions Here well analyze the scenarios and perform the necessary calculat... View full answer

Get step-by-step solutions from verified subject matter experts