Question: Suppose that t is normally distributed with mean zero and standard deviation for all t. Determine and report the distribution of the hedged strategys (continuously

Suppose that t is normally distributed with mean zero and standard deviation for all t. Determine and report the distribution of the hedged strategys (continuously compounded) monthly return per month.

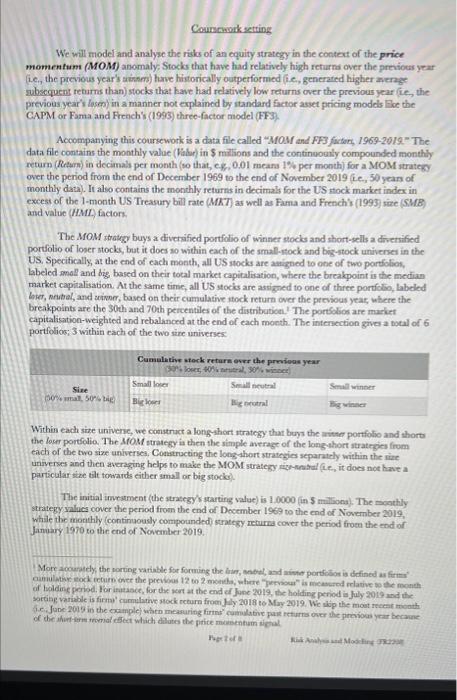

-

Report the ML parameters, measured per annum, of a BSM model fitted to the hedged strategy. Using no more than 100 words, compare the estimates for the hedged strategy with the ones for the unhedged strategy from Question 1, and discuss the implications.

-

c) Use the estimated BSM parameters from Question 8b) to calculate the monthly expected value of the hedged strategy at each date (month-end) in the sample period conditional on its value at the beginning of the sample period. Add this expected monthly value as a function of the date to the plot you made in Question 7c) and report the plot (adjust the axes as you see fit). Also,

c) Given rth , the hedged strategys value at the end of any month t>0 is Sh=Sh erth.

t t1 t1 t2 t1 we can write the above as

Sh =Sh erh , Sh =Sh erh erh =Sh erh +rh.

t t2 t1 t t2 t1 t Continuing this recursively, we get

Page 7 of 8 Risk Analysis and Modelling (FR2208)

report the expected value of the hedged strategy on

-

i) 31 December 1970,

-

ii) 31 December 1994,

iii) 31 November 2019.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts