Question: Suppose that the agent has initial wealth A = 1 to invest in two financial assets, one riskless and one risky. The price of the

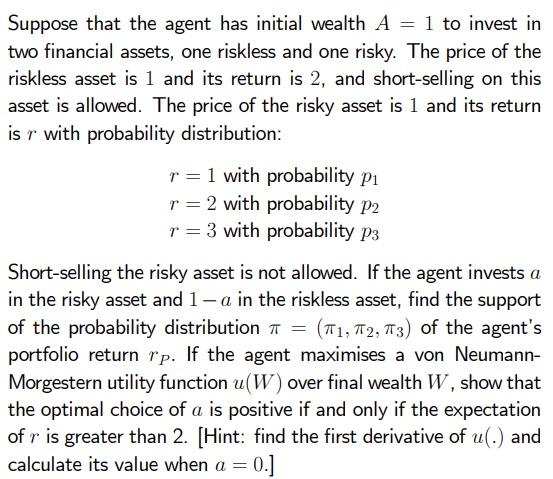

Suppose that the agent has initial wealth A = 1 to invest in two financial assets, one riskless and one risky. The price of the riskless asset is 1 and its return is 2, and short-selling on this asset is allowed. The price of the risky asset is 1 and its return is r with probability distribution: r = 1 with probability Pi r=2 with probability P2 r = 3 with probability P3 Short-selling the risky asset is not allowed. If the agent invests a in the risky asset and 1-a in the riskless asset, find the support of the probability distribution = (T1, T2,73) of the agent's portfolio return rp. If the agent maximises a von Neumann- Morgestern utility function (W) over final wealth W, show that the optimal choice of a is positive if and only if the expectation of r is greater than 2. (Hint: find the first derivative of u(.) and calculate its value when a = 0.] Suppose that the agent has initial wealth A = 1 to invest in two financial assets, one riskless and one risky. The price of the riskless asset is 1 and its return is 2, and short-selling on this asset is allowed. The price of the risky asset is 1 and its return is r with probability distribution: r = 1 with probability Pi r=2 with probability P2 r = 3 with probability P3 Short-selling the risky asset is not allowed. If the agent invests a in the risky asset and 1-a in the riskless asset, find the support of the probability distribution = (T1, T2,73) of the agent's portfolio return rp. If the agent maximises a von Neumann- Morgestern utility function (W) over final wealth W, show that the optimal choice of a is positive if and only if the expectation of r is greater than 2. (Hint: find the first derivative of u(.) and calculate its value when a = 0.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts