Question: Suppose that the agent has initial wealth A = 1 to invest in two financial assets, one riskless and one risky. The price of

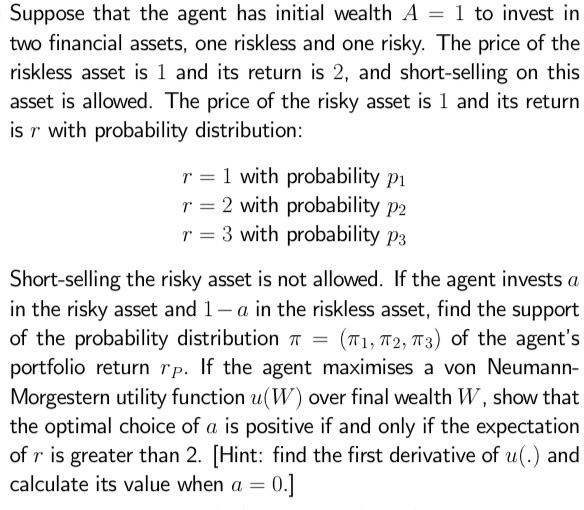

Suppose that the agent has initial wealth A = 1 to invest in two financial assets, one riskless and one risky. The price of the riskless asset is 1 and its return is 2, and short-selling on this asset is allowed. The price of the risky asset is 1 and its return is r with probability distribution: r = 1 with probability pi r = 2 with probability p2 r = 3 with probability p3 Short-selling the risky asset is not allowed. If the agent invests a in the risky asset and 1-a in the riskless asset, find the support of the probability distribution = (T1, T2, T3) of the agent's portfolio return rp. If the agent maximises a von Neumann- Morgestern utility function u(W) over final wealth W, show that the optimal choice of a is positive if and only if the expectation of r is greater than 2. [Hint: find the first derivative of u(.) and calculate its value when a = 0.]

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

To find the support of the probability distribution T1 T2 T3 of the agents portfolio return rp we need to consider the different possible outcomes bas... View full answer

Get step-by-step solutions from verified subject matter experts