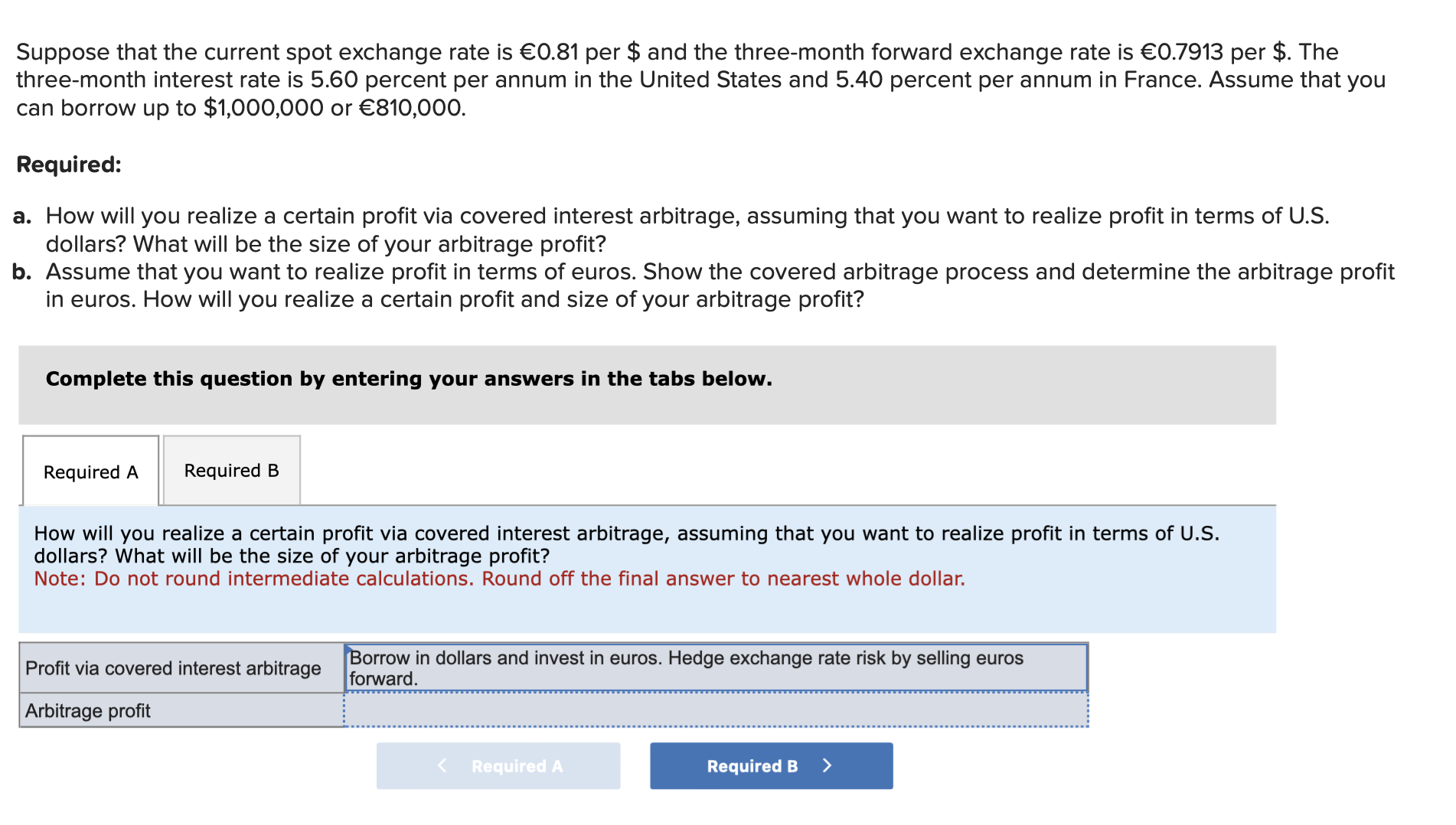

Question: Suppose that the current spot exchange rate is 0 . 8 1 per $ and the three - month forward exchange rate is 0 .

Suppose that the current spot exchange rate is per $ and the threemonth forward exchange rate is per $ The Assume that you want to realize profit in terms of euros. Show the covered arbitrage process and determine the arbitrage

profit in euros. How will you realize a certain profit and size of your arbitrage profit?

Note: Do not round intermediate calculations. Round off the final answer to nearest whole dollar.

How will you realize a certain profit?

Borrow in dollars and invest in euros. Hedge exchange rate risk by selling just

enough euros forward to repay your dollar loan.

Arbitrage profit

threemonth interest rate is percent per annum in the United States and percent per annum in France. Assume that you

can borrow up to $ or

Required:

a How will you realize a certain profit via covered interest arbitrage, assuming that you want to realize profit in terms of US

dollars? What will be the size of your arbitrage profit?

b Assume that you want to realize profit in terms of euros. Show the covered arbitrage process and determine the arbitrage profit

in euros. How will you realize a certain profit and size of your arbitrage profit?

Complete this question by entering your answers in the tabs below.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock