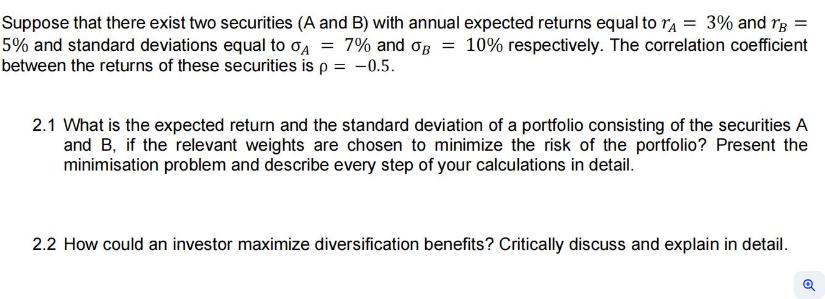

Question: Suppose that there exist two securities (A and B) with annual expected returns equal to = 3% and B = 5% and standard deviations

Suppose that there exist two securities (A and B) with annual expected returns equal to = 3% and B = 5% and standard deviations equal to OA = 7% and OB = 10% respectively. The correlation coefficient between the returns of these securities is p = -0.5. 2.1 What is the expected return and the standard deviation of a portfolio consisting of the securities A and B, if the relevant weights are chosen to minimize the risk of the portfolio? Present the minimisation problem and describe every step of your calculations in detail. 2.2 How could an investor maximize diversification benefits? Critically discuss and explain in detail. Q

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

22 Maximizing Diversification Benefits Diversification benefits can be maximized by selecting assets ... View full answer

Get step-by-step solutions from verified subject matter experts