In a previous example, Mark Young received $50,000 a year for 20 years from the state lottery.

Question:

In a previous example, Mark Young received $50,000 a year for 20 years from the state lottery. In that example, he was to receive the first payment in one year. Let us now assume that the first payment occurs immediately. The total number of payments remains 20.

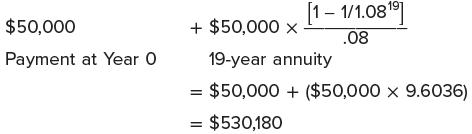

Under this new assumption, we have a 19-year annuity with the first payment occurring at Year 1—plus an extra payment at Year 0. The present value is:

$530,180, the present value in this example, is greater than $490,907, the present value in the earlier lottery example. This is to be expected because the annuity of the current example begins earlier. An annuity with an immediate initial payment is called an annuity in advance or, more commonly, an annuity due. Always remember that Equation 4.15 and Table A.2 in this book refer to an ordinary annuity.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe