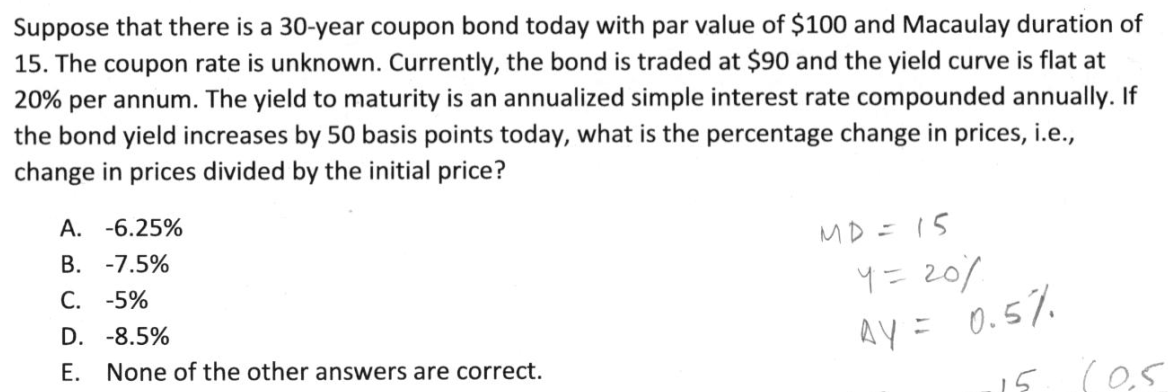

Question: Suppose that there is a 3 0 - year coupon bond today with par value of $ 1 0 0 and Macaulay duration of The

Suppose that there is a year coupon bond today with par value of $ and Macaulay duration of

The coupon rate is unknown. Currently, the bond is traded at $ and the yield curve is flat at

per annum. The yield to maturity is an annualized simple interest rate compounded annually. If

the bond yield increases by basis points today, what is the percentage change in prices, ie

change in prices divided by the initial price?

A

B

C

D

E None of the other answers are correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock