Question: Suppose that we apply a discrete-time model to model both a non-dividend paying stock's price and the risk-free rate. Each period is one year.

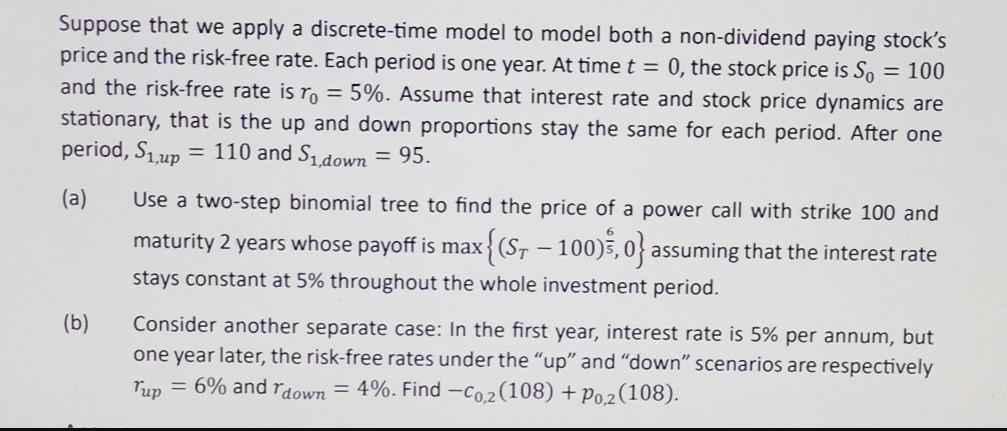

Suppose that we apply a discrete-time model to model both a non-dividend paying stock's price and the risk-free rate. Each period is one year. At time t = 0, the stock price is So = 100 and the risk-free rate is ro = 5%. Assume that interest rate and stock price dynamics are stationary, that is the up and down proportions stay the same for each period. After one period, S,up 110 and S,down = 95. = (a) Use a two-step binomial tree to find the price of a power call with strike 100 and maturity 2 years whose payoff is max {(S - 100), 0} assuming that the interest rate stays constant at 5% throughout the whole investment period. (b) Consider another separate case: In the first year, interest rate is 5% per annum, but one year later, the risk-free rates under the "up" and "down" scenarios are respectively Tup = 6% and down = 4%. Find -Co,2 (108) + Po.2 (108).

Step by Step Solution

There are 3 Steps involved in it

a To find the price of a power call with a strike of 100 and a maturity of 2 years we need to calcul... View full answer

Get step-by-step solutions from verified subject matter experts