Question: Suppose that you are analyzing two bonds, both that pay a 10 percent coupon and make semiannual payments. The first bond, Bond A, matures in

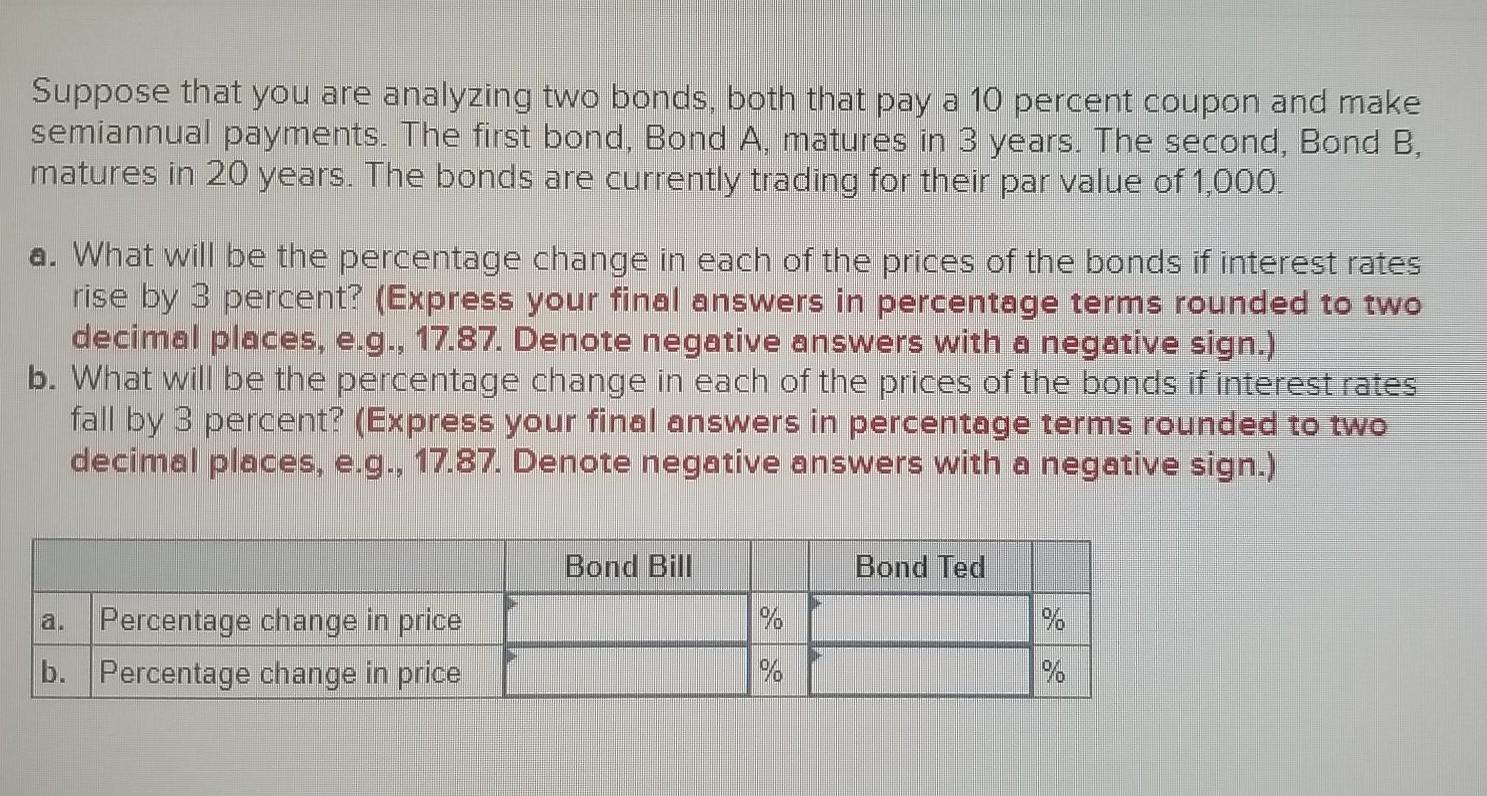

Suppose that you are analyzing two bonds, both that pay a 10 percent coupon and make semiannual payments. The first bond, Bond A, matures in 3 years. The second, Bond B, matures in 20 years. The bonds are currently trading for their par value of 1,000. a. What will be the percentage change in each of the prices of the bonds if interest rates rise by 3 percent? (Express your final answers in percentage terms rounded to two decimal places, e.g., 17.87. Denote negative answers with a negative sign.) b. What will be the percentage change in each of the prices of the bonds if interest rates fall by 3 percent? (Express your final answers in percentage terms rounded to two decimal places, e.g., 17.87. Denote negative answers with a negative sign.) Bond Bill Bond Ted % % Percentage change in price b. Percentage change in price % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts