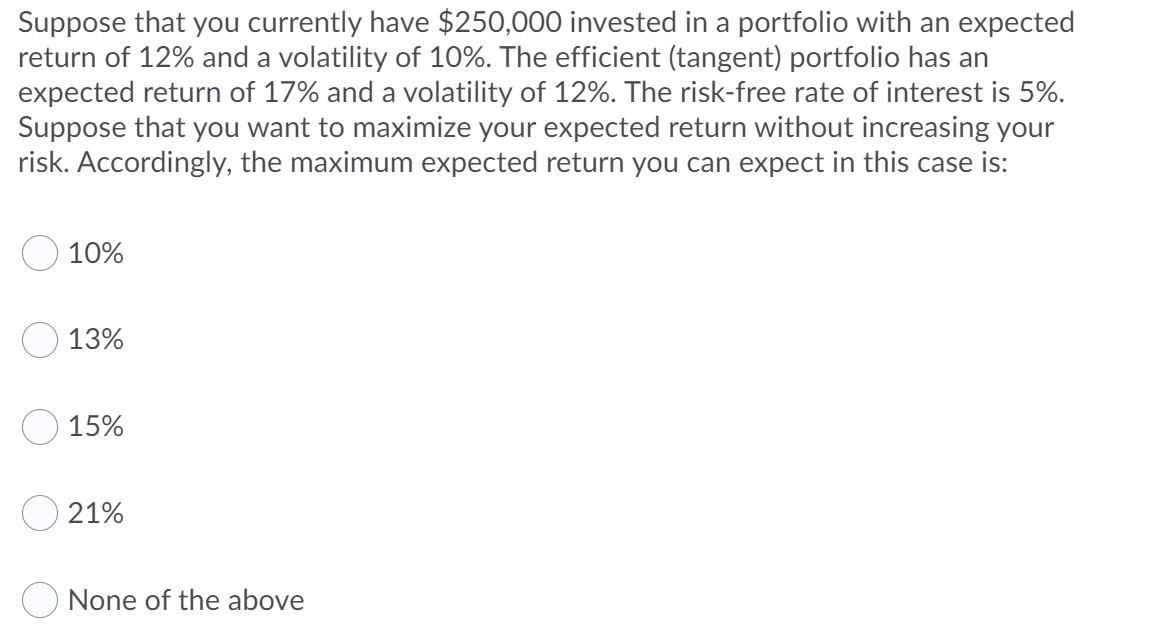

Question: Suppose that you currently have $ 2 5 0 , 0 0 0 invested in a portfolio with an expected return of 1 2 %

Suppose that you currently have $ invested in a portfolio with an expected return of and a volatility of The efficient tangency portfolio has an expected return of and a volatility of The riskfree rate of interest is You want to maximize your expected return without increasing your risk. Without increasing your volatility beyond its current the maximum expected return you could earn is closest to:

Question Answer

a

b

c

d

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock