Question: Suppose that you have $ 2 , 0 0 0 extra money to invest and are actively searching for good investment opportunities. You were told

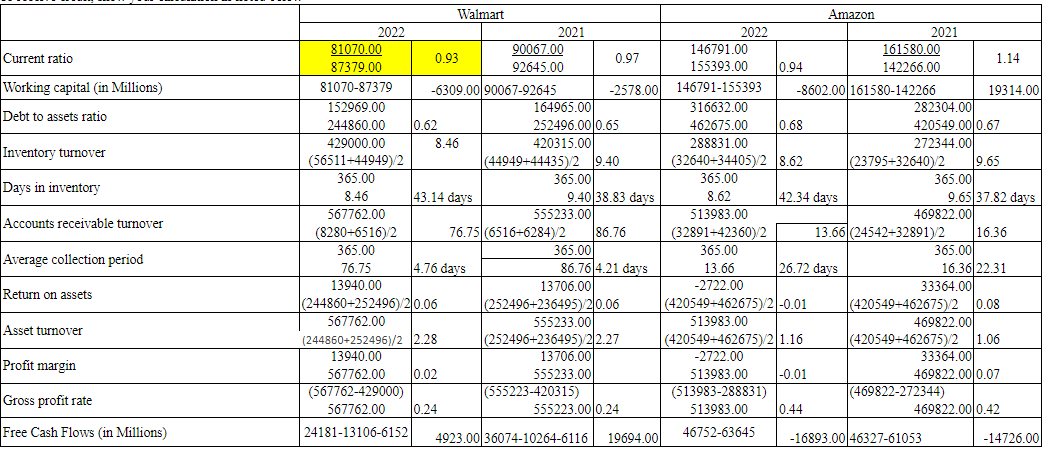

Suppose that you have $ extra money to invest and are actively searching for good investment opportunities. You were told that Walmart is a great retailer. You will perform a ratiobased analysis to get more insights into the Company's financial position, operational efficiency, and profitability. You will also perform a ratiobased comparative analysis using

the Company's key competitor, Amazon, and its financial information. This comparative analysis will allow you to understand Walmart's competitiveness within the industry better.

You will now perform a ratiobased narrative analysis based on the ratios you calculated. You should divide your discussion into four parts: analysis for

liquidity, solvency, operational efficiency, and profitability. Ensure that the proper ratios are chosen to discuss a specific analysis part. Find the relationships among ratios and trends over the two years compared. Also, compare Walmart's relationships and trends with those of Amazon. In the last paragraph of your discussion, you should make your final investment

decision: buy or not to buy Walmart. You may want to split your investment between the two companies. Also, discuss our rationale behind your final decision. Your discussion and final investment decision should solely be based on the ratio calculations, although investors may also use various nonfinancial information in their investment decisionmaking.

Please help me with the analysis using the provided calculations!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock