Question

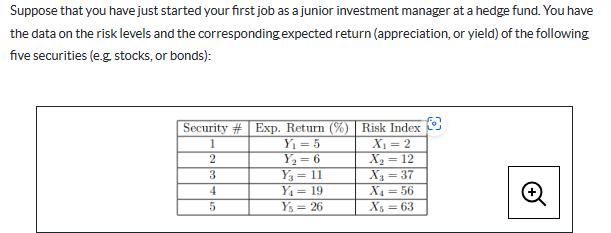

Suppose that you have just started your first job as a junior investment manager at a hedge fund. You have the data on the

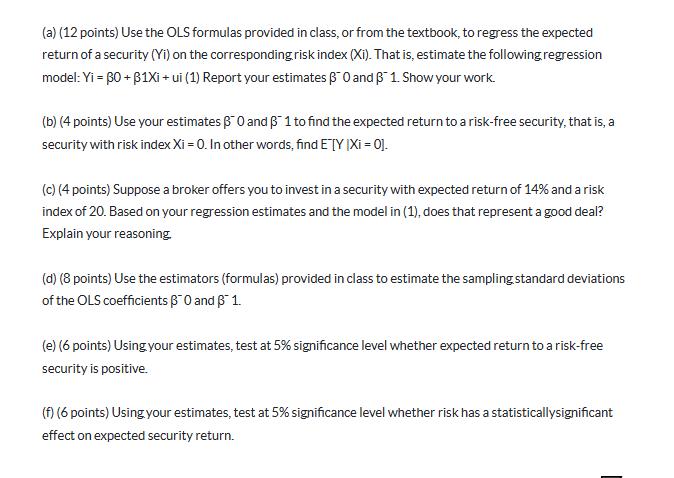

Suppose that you have just started your first job as a junior investment manager at a hedge fund. You have the data on the risk levels and the corresponding expected return (appreciation, or yield) of the following five securities (e.g. stocks, or bonds): Security #Exp. Return (%) Risk Index 1 Y =5 X = 2 2 Y2=6 X2-12 3 Y=11 X=37 4 Y=19 X4-56 5 Y = 26 Xs=63 (a) (12 points) Use the OLS formulas provided in class, or from the textbook, to regress the expected return of a security (Yi) on the corresponding risk index (Xi). That is, estimate the following regression model: Yi = 30+ B1Xi + ui (1) Report your estimates 0 and 1. Show your work. (b) (4 points) Use your estimates 0 and 1 to find the expected return to a risk-free security, that is, a security with risk index Xi = 0. In other words, find E[Y (Xi = 0]. (c) (4 points) Suppose a broker offers you to invest in a security with expected return of 14% and a risk index of 20. Based on your regression estimates and the model in (1), does that represent a good deal? Explain your reasoning (d) (8 points) Use the estimators (formulas) provided in class to estimate the sampling standard deviations of the OLS coefficients TO and * 1. (e) (6 points) Using your estimates, test at 5% significance level whether expected return to a risk-free security is positive. (f) (6 points) Using your estimates, test at 5% significance level whether risk has a statisticallysignificant effect on expected security return.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started