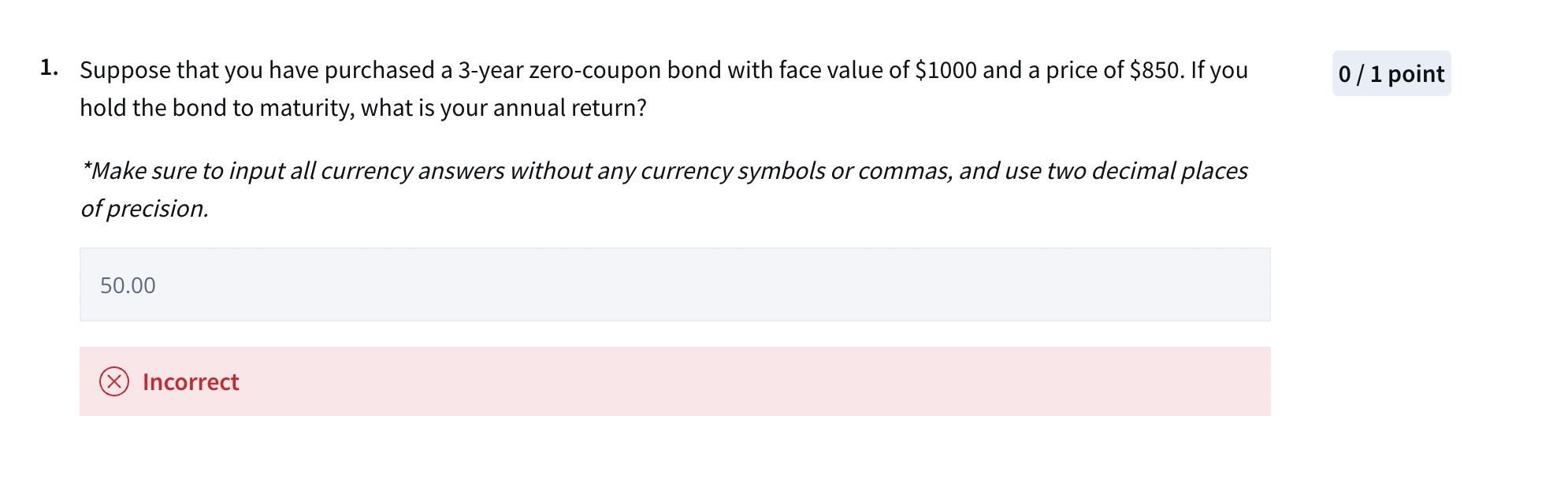

Question: Suppose that you have purchased a 3 - year zero - coupon bond with face value of $ 1 0 0 0 and a price

Suppose that you have purchased a year zerocoupon bond with face value of $ and a price of $ If you Suppose you bought a fiveyear zerocoupon Treasury bond for $ per $ face value. Assume the yield to

maturity on comparable bonds increases to after you purchase the bond and remains there. Calculate your

holding period return annual return if you sell the bond after one year.

Make sure to input all currency answers without any currency symbols or commas, and use two decimal places

of precision.

Incorrect

Suppose you bought a fiveyear zerocoupon Treasury bond for $ per $ face value. Assuming yields to

maturity on comparable bonds remain at calculate your holding period return if you sell the bond after two

years.

Make sure to input all currency answers without any currency symbols or commas, and use two decimal places

of precision.

hold the bond to maturity, what is your annual return?

Make sure to input all currency answers without any currency symbols or commas, and use two decimal places

of precision.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock