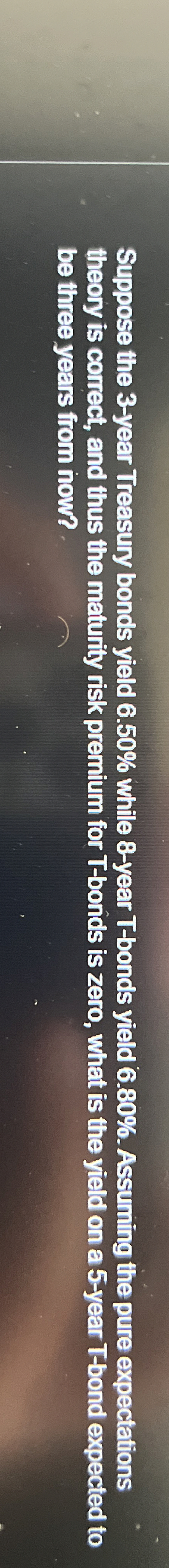

Question: Suppose the 3 - year Treasury bonds yield 6 . 5 0 % while 8 - year T - bonds yield 6 . 8 0

Suppose the year Treasury bonds yield while year Tbonds yield Assuming the pure expectations

theory is correct, and thus the maturity risk premium for Tbonds is zero, what is the yield on a year Tbond expected to

be three years from how?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock