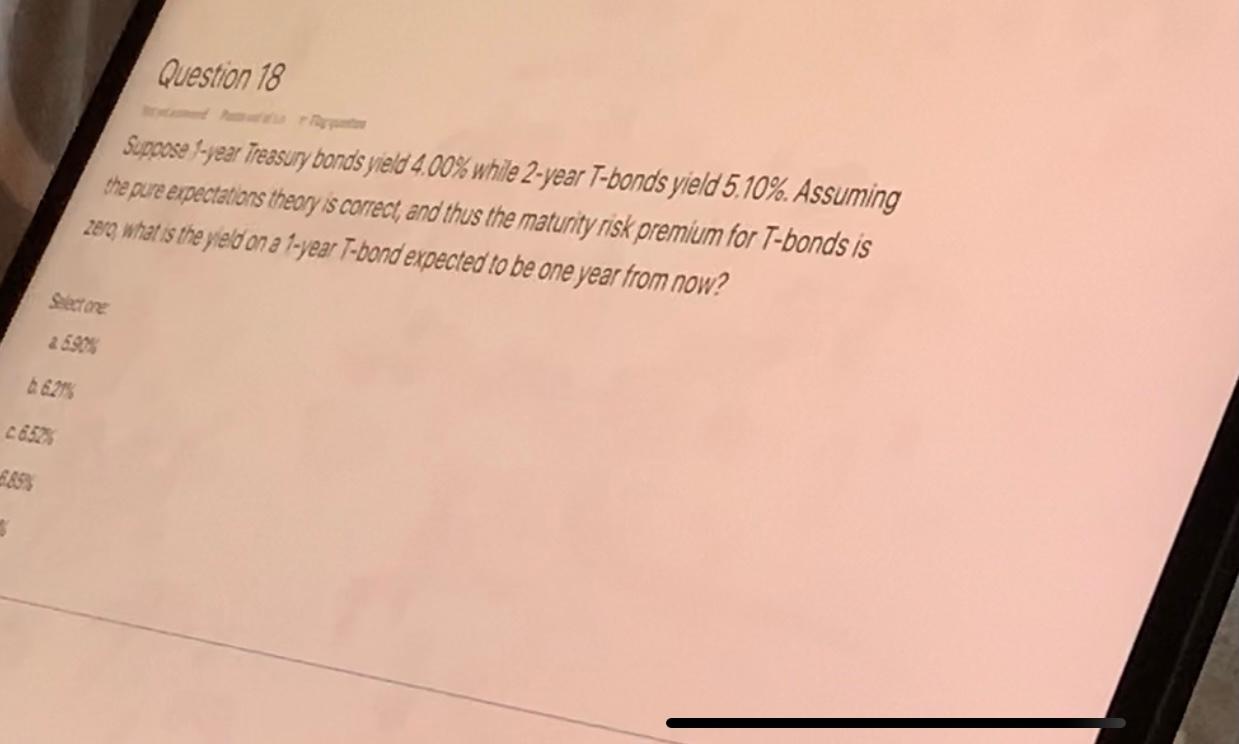

Question: Question 18 Supoose -year Treasury bonds yield 4.00% while 2-year T-bonds yield 5,10%. Assuming the pure expectations theory is correct, and thus the maturity risk

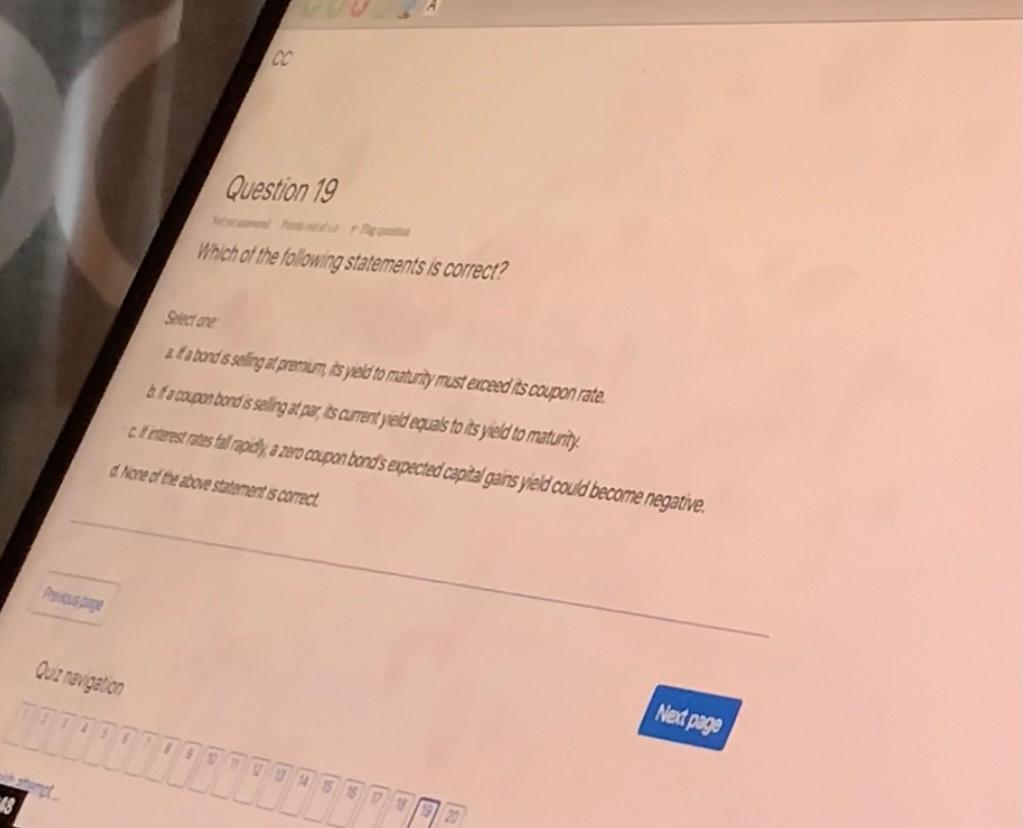

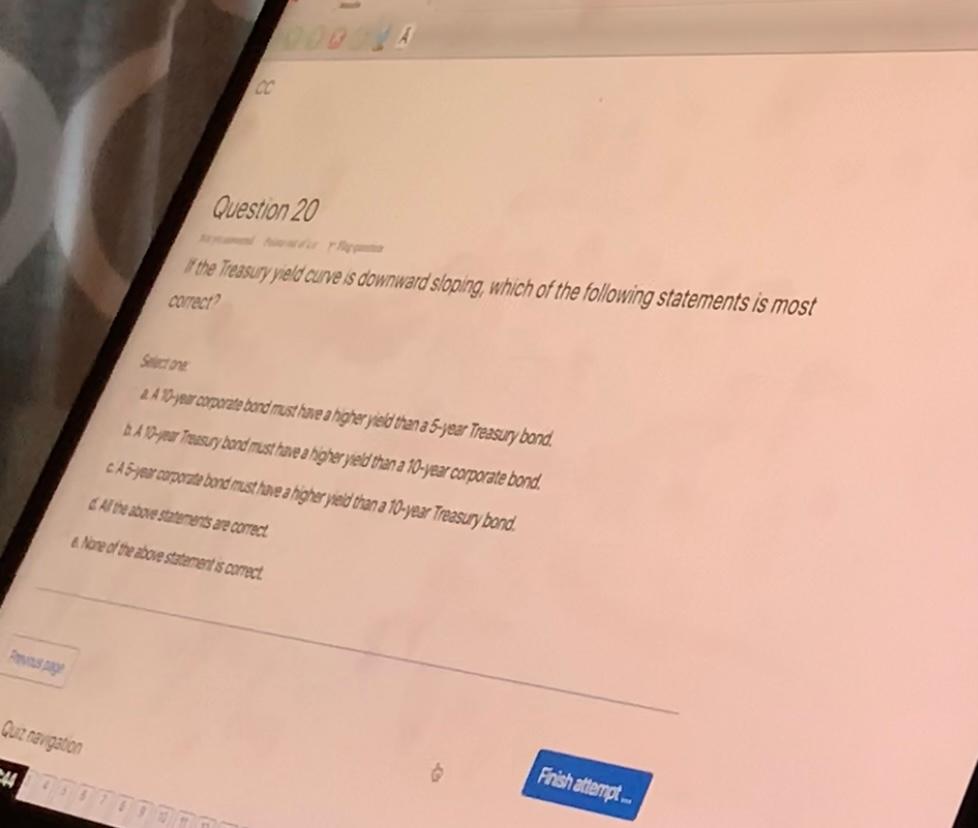

Question 18 Supoose -year Treasury bonds yield 4.00% while 2-year T-bonds yield 5,10%. Assuming the pure expectations theory is correct, and thus the maturity risk premium for T-bonds is zero what is the yield on a 1-year T-bond expected to be one year from now? Sector 2699 C8525 365 $ Question 19 Which of the following statements is correct? 2 tandssaingat permum syed to maturity must exceed is coupon rate. a facapon berd is sailing at par, is current yieldequas to its yield to maturity. crterest rates falrad), a zero coupon bonds expected capital gans yield could become negative. dos de above statement is correct Paasam Quz navigation Next page 15 Question 20 the Treasury yield curve is downward sloping, which of the following statements is most correct? 2A 7-year corporate bond musthaea higher yield than a 5-year Treasury bond. LA D-jeur Tuussy band must have a higher yield than a 10-year corporate bond. CA 5 jer corporate bond must have a higher yield than a 10-year Treasury bond. Ale statements are correct a lor of the above statement is correct Quiz navgation 4452 Frish attempt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts