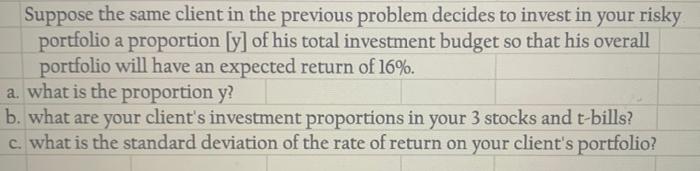

Question: Suppose the same client in the previous problem decides to invest in your risky portfolio a proportion [y] of his total investment budget so that

![in your risky portfolio a proportion [y] of his total investment budget](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f963787d200_96066f963781a188.jpg)

Suppose the same client in the previous problem decides to invest in your risky portfolio a proportion [y] of his total investment budget so that his overall portfolio will have an expected return of 16%. a. what is the proportion y? b. what are your client's investment proportions in your 3 stocks and t-bills? c. what is the standard deviation of the rate of return on your client's portfolio? Assume that you manage a risky portfolio with an expected rate of return of 14.5% and a standard deviation of 25%. The t-bill rate is 3%. Your client, who is relatively risk averse, chooses to invest 55% in your portfolio and the remainder of their funds in a t-bill money market fund. What is the expected return and standard deviation of your client's portfolio? If your risk portfolio includes the following investments in the given proportions: Stock X Stock Y Stock Z 51% 30% 19%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts