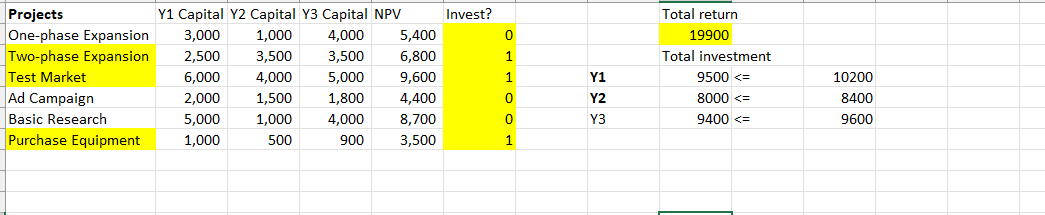

Question: Suppose the two expansion projects are mutually exclusive and only one of them can be made. How does this alter the solution in part a?

Suppose the two expansion projects are mutually exclusive and only one of them can be made. How does this alter the solution in part a?

To add this ability to your model in part a., you only need to add one additional constraint, using the sum of the "investment decisions" of the two expansion projects. Think about all the possibilities for the sum and which you of them you need to exclude. (For example, if one-phase is selected but two-phase is not, the sum of the decisions in cells F2 and F3 will be 1.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts