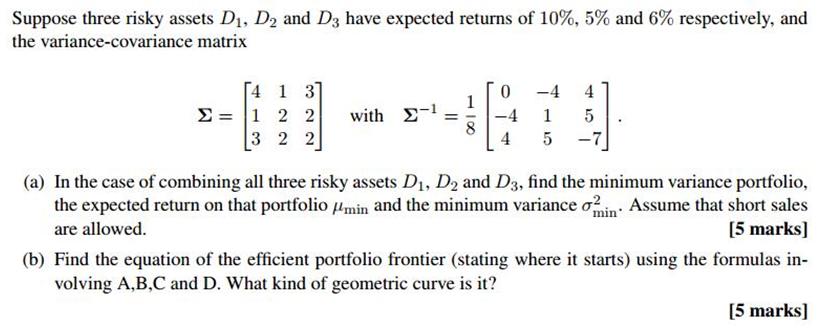

Question: Suppose three risky assets D, D and D3 have expected returns of 10%, 5% and 6% respectively, and the variance-covariance matrix 4 1 3

Suppose three risky assets D, D and D3 have expected returns of 10%, 5% and 6% respectively, and the variance-covariance matrix 4 1 3 = |1 2 2 322 with 1, 1 8 0 4 -4 4 1 5 5 -7 (a) In the case of combining all three risky assets D, D2 and D3, find the minimum variance portfolio, the expected return on that portfolio min and the minimum variance on. Assume that short sales are allowed. [5 marks] min (b) Find the equation of the efficient portfolio frontier (stating where it starts) using the formulas in- volving A,B,C and D. What kind of geometric curve is it? [5 marks]

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

To find the minimum variance portfolio and the efficient portfolio frontier we need to perform some calculations based on the given information a Minimum Variance Portfolio The weights of the assets i... View full answer

Get step-by-step solutions from verified subject matter experts