Question: Suppose we run a six-factor model, including market, size, value, momentum, profitability (RMW) and investments (CMA). The regression results are as below: Compare the six-factor

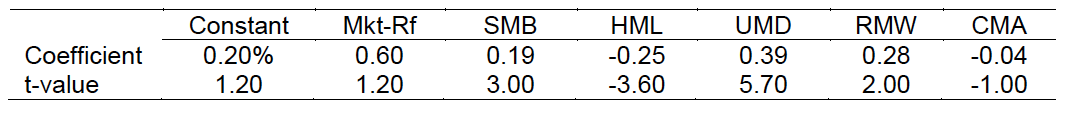

Suppose we run a six-factor model, including market, size, value, momentum, profitability (RMW) and investments (CMA). The regression results are as below:

Compare the six-factor alpha with the four-model alpha and discuss the difference in the context of active fund management.

Constant Mkt-Rf SMB HML UMD RMW CMA Coefficient t-value 0.20% 0.60 0.19 -0.25 0.39 0.28 -0.04 1.20 1.20 3.00 -3.60 5.70 2.00 -1.00

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

In the context of active fund management comparing the alpha generated by different models can provide insights into the effectiveness of the addition... View full answer

Get step-by-step solutions from verified subject matter experts