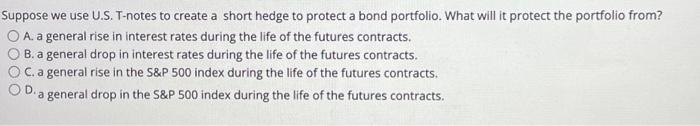

Question: Suppose we use U.S. T-notes to create a short hedge to protect a bond portfolio. What will it protect the portfolio from? A. a general

Suppose we use U.S. T-notes to create a short hedge to protect a bond portfolio. What will it protect the portfolio from? A. a general rise in interest rates during the life of the futures contracts. B. a general drop in interest rates during the life of the futures contracts. C. a general rise in the S&P 500 index during the life of the futures contracts. a general drop in the S&P 500 index during the life of the futures contracts. a D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts