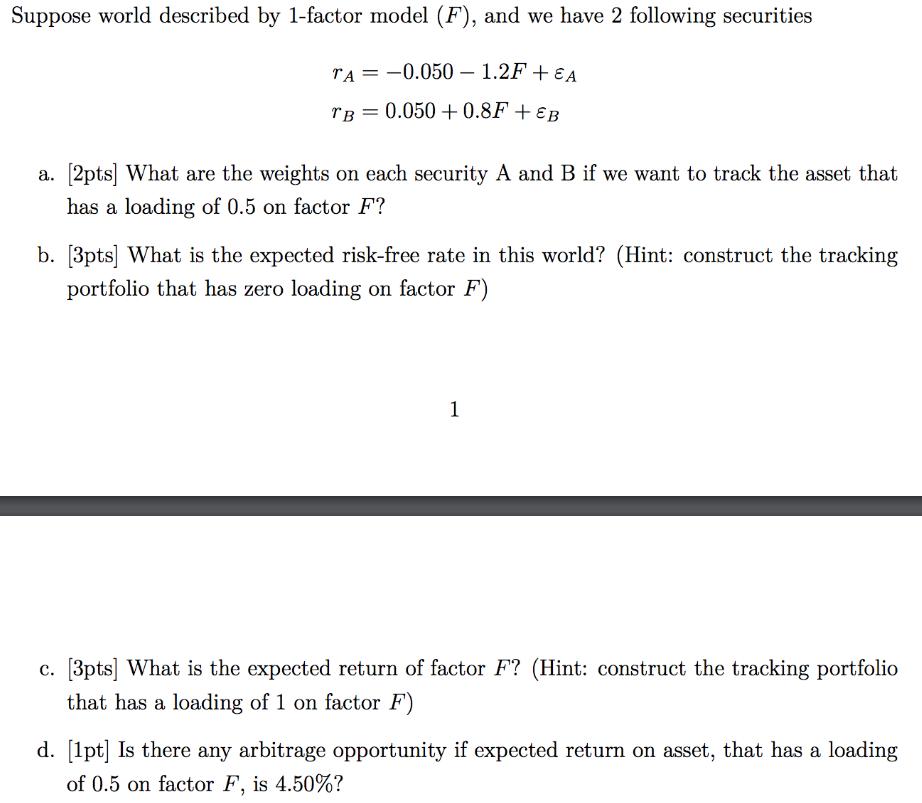

Question: Suppose world described by 1-factor model (F), and we have 2 following securities TA= -0.050- 1.2F + EA TB = 0.050 +0.8F + EB

Suppose world described by 1-factor model (F), and we have 2 following securities TA= -0.050- 1.2F + EA TB = 0.050 +0.8F + EB a. [2pts] What are the weights on each security A and B if we want to track the asset that has a loading of 0.5 on factor F? b. [3pts] What is the expected risk-free rate in this world? (Hint: construct the tracking portfolio that has zero loading on factor F) 1 c. [3pts] What is the expected return of factor F? (Hint: construct the tracking portfolio that has a loading of 1 on factor F) d. [1pt] Is there any arbitrage opportunity if expected return on asset, that has a loading of 0.5 on factor F, is 4.50%?

Step by Step Solution

3.31 Rating (163 Votes )

There are 3 Steps involved in it

a To have a loading of 05 on F we want wA12 wB08 05 So... View full answer

Get step-by-step solutions from verified subject matter experts