Question: Suppose you are analyzing a potential project for your small business. It will cost you $75,000 now to purchase all the assets necessary, and

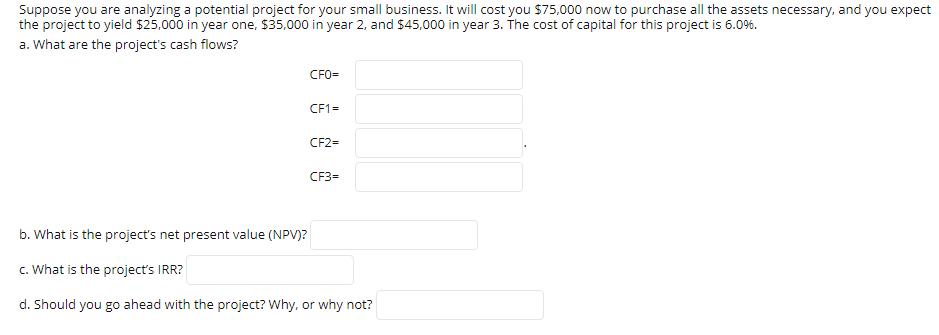

Suppose you are analyzing a potential project for your small business. It will cost you $75,000 now to purchase all the assets necessary, and you expect the project to yield $25,000 in year one, $35,000 in year 2, and $45,000 in year 3. The cost of capital for this project is 6.0%. a. What are the project's cash flows? CFO= CF1= CF2= CF3= b. What is the project's net present value (NPV)? c. What is the project's IRR? d. Should you go ahead with the project? Why, or why not?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts