Question: Suppose you are using SOFR discounting (use zero rates implied by SOFR to discount payments). For this problem, all the swaps feature semiannual payments,

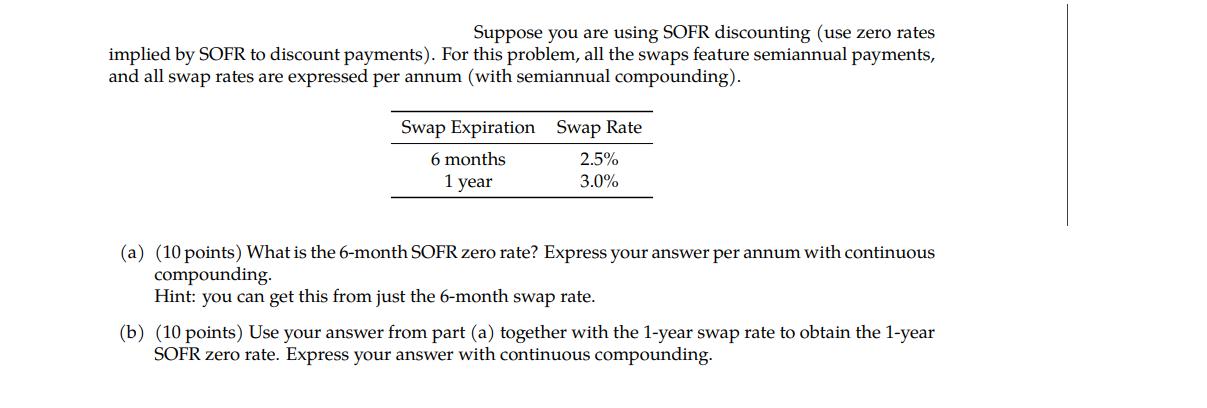

Suppose you are using SOFR discounting (use zero rates implied by SOFR to discount payments). For this problem, all the swaps feature semiannual payments, and all swap rates are expressed per annum (with semiannual compounding). Swap Expiration Swap Rate 6 months 2.5% 1 year 3.0% (a) (10 points) What is the 6-month SOFR zero rate? Express your answer per annum with continuous compounding. Hint: you can get this from just the 6-month swap rate. (b) (10 points) Use your answer from part (a) together with the 1-year swap rate to obtain the 1-year SOFR zero rate. Express your answer with continuous compounding.

Step by Step Solution

3.31 Rating (148 Votes )

There are 3 Steps involved in it

To solve this problem we need to use the relationship between swap rates and zero rates Given inform... View full answer

Get step-by-step solutions from verified subject matter experts