Question: Suppose you have two projects A and B which run for four periods. A has a cashflow stream of {-5, 0, 2, 1, 4),

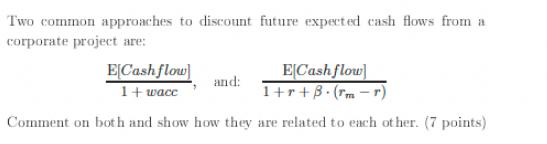

![]()

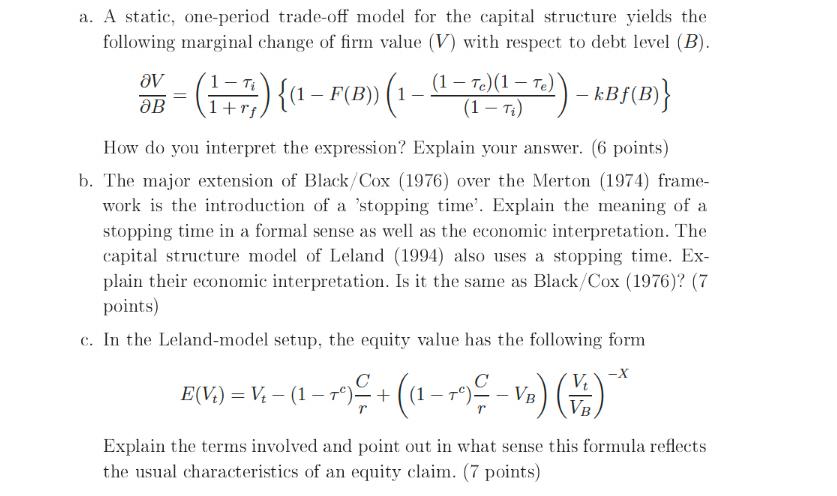

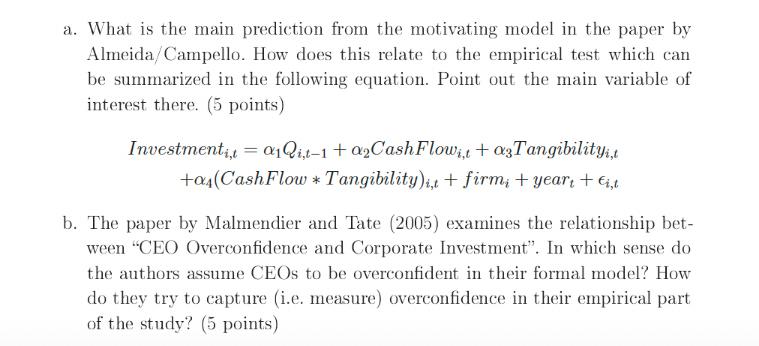

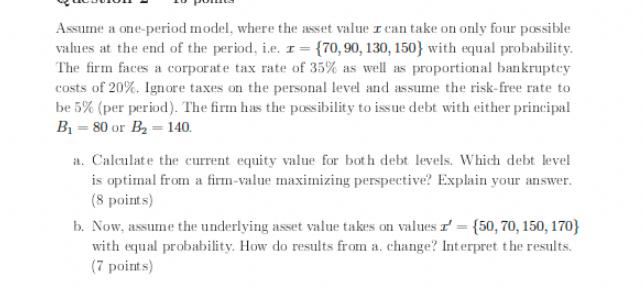

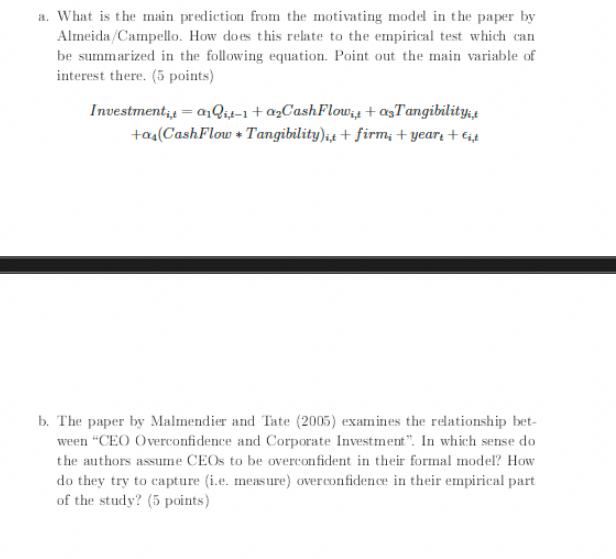

Suppose you have two projects A and B which run for four periods. A has a cashflow stream of {-5, 0, 2, 1, 4), and for B it is {-2, 2, -2, 4, -1}. By discounting at 5% per period, which project do you prefer according to (i) the NPV, and (ii) the Profitability index. Explain your answer. If you were to calculate the Internal rate of return for the two projects, what kind of result would you expect? (10 points) Show how the operating leverage impacts the asset beta. (7 points) a. A static, one-period trade-off model for the capital structure yields the following marginal change of firm value (V) with respect to debt level (B). B Ti -(1-7){(1-P(B)) (1-(1-1)(1-1)) - kBF(B)} Ti) 1+rf = How do you interpret the expression? Explain your answer. (6 points) b. The major extension of Black/Cox (1976) over the Merton (1974) frame- work is the introduction of a 'stopping time. Explain the meaning of a stopping time in a formal sense as well as the economic interpretation. The capital structure model of Leland (1994) also uses a stopping time. Ex- plain their economic interpretation. Is it the same as Black/Cox (1976)? (7 points) c. In the Leland-model setup, the equity value has the following form -X E(V.) = V - (1-79) + ((1+)-v) () r Explain the terms involved and point out in what sense this formula reflects the usual characteristics of an equity claim. (7 points) a. What is the main prediction from the motivating model in the paper by Almeida/Campello. How does this relate to the empirical test which can be summarized in the following equation. Point out the main variable of interest there. (5 points) Investmentit = aQit-1 + aCash Flowit+asTangibility, t +04(Cash Flow * Tangibility),t + firmi + yeart + Ei, t b. The paper by Malmendier and Tate (2005) examines the relationship bet- ween "CEO Overconfidence and Corporate Investment". In which sense do the authors assume CEOs to be overconfident in their formal model? How do they try to capture (i.e. measure) overconfidence in their empirical part of the study? (5 points) Explain why the NPV criteria can be considered to be consistent with consumption/investment-diagram utility-maximization. Use a one-period for your answer. (5 points) Assume company XYZ has a leverage ratio L equal to 3. It holds 25% of its assets in cash. Its equity beta is 2.4. The debt is not risk-free and has thus a beta of 0.2. (10 points) i. Determine the beta for the remaining assets (i.e. excluding cash) ii. Now assume, the company uses all its cash to pay back debt. Determine the equity beta after this transaction. How do you interpret the result? Two common approaches to discount future expected cash flows from a corporate project are: ECash flow 1+r+B. (rm-r) Comment on both and show how they are related to each other. (7 points) E[Cash flow 1+ wace and: Assume a one-period model, where the asset value I can take on only four possible values at the end of the period, i.e. r= {70, 90, 130, 150) with equal probability. The firm faces a corporate tax rate of 35% as well as proportional bankruptcy costs of 20%. Ignore taxes on the personal level and assume the risk-free rate to be 5% (per period). The firm has the possibility to issue debt with either principal B = 80 or B = 140. a. Calculate the current equity value for both debt levels. Which debt level is optimal from a firm-value maximizing perspective? Explain your answer. (8 points) b. Now, assume the underlying asset value takes on values r = {50, 70, 150, 170) with equal probability. How do results from a. change? Interpret the results. (7 points) a. What is the main prediction from the motivating model in the paper by Almeida/Campello. How does this relate to the empirical test which can be summarized in the following equation. Point out the main variable of interest there. (5 points) Investmenti, ai,t-1 + aCash Flowi,t +asTangibility, t +04 (Cash Flow Tangibility) + firm, + year, +t b. The paper by Malmendier and Tate (2005) examines the relationship bet- ween "CEO Overconfidence and Corporate Investment". In which sense do the authors assume CEOs to be overconfident in their formal model? How do they try to capture (i.e. measure) overconfidence in their empirical part of the study? (5 points)

Step by Step Solution

There are 3 Steps involved in it

ANSWER a NPV and Profitability Index Comparison i NPV Project A NPV 5 0105 21052 11053 41054 078 Project B NPV 2 2105 21052 41053 11054 062 Based on the NPV Project A is preferred as it has a higher N... View full answer

Get step-by-step solutions from verified subject matter experts