Question: Suppose you need to decide whether to keep a machine or replace it with a new one: Old machine: old machine can operate for 5

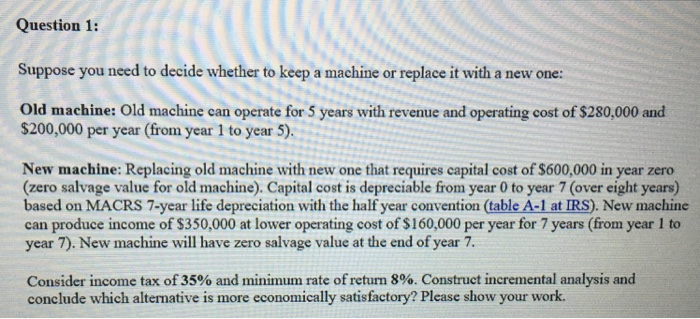

Suppose you need to decide whether to keep a machine or replace it with a new one: Old machine: old machine can operate for 5 years with revenue and operating cost of $280,000 and $200,000 per year (from year 1 to year 5). New machine: Replacing old machine with new one that requires capital cost of $600,000 in year zero (zero salvage value for old machine). Capital cost is depreciable from year 0 to year 7 (over eight years) based on MACRS 7-year life depreciation with the half year convention (table A-1 at IRS). New machine can produce income of $350,000 at lower operating cost of $160,000 per year for 7 years (from year 1 to year 7). New machine will have zero salvage value at the end of year 7. Consider income tax of 35% and minimum rate of return 8% Construct incremental analysis and conclude which alternative is more economically satisfactory? Please show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts