Question: Suppose you need to decide whether to keep a machine or replace it with a new one: Old machine: The old machine can operate for

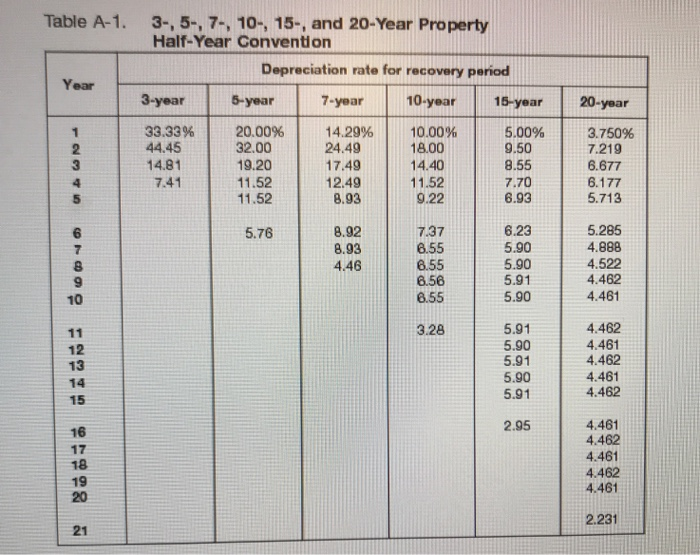

Suppose you need to decide whether to keep a machine or replace it with a new one: Old machine: The old machine can operate for 5 years with operating cost of $120.000 per year New machine Replacing the old machine with a new one requires a capital cost of S2500 O in year zero (assume that there is zero salvage value for old machine). The capital cost is depreciable from year O to year 5 (over six years) based on MACRS 5-year life depreciation with the half year convention (table A-1.at IRS e).The new machine has a lower operating cost of $45,000 per year for 5 years (from year 1 to year 5) Assume both machines produce similar good with similar value that yields similar revenue. onsider income tax of 35% and a discount rate of 10% anually. In present discounted value terms, how much will you save by replacing the old machine with the new machine? (Note: What you are being asked to do here is to conduct incremental NPV analysis on the new machine versus the old machine, NPVnew machne ald machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts