Question: SWAP example USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) Black Gold Industries (BGI) is an independent oil producer with production capacity of 500,000

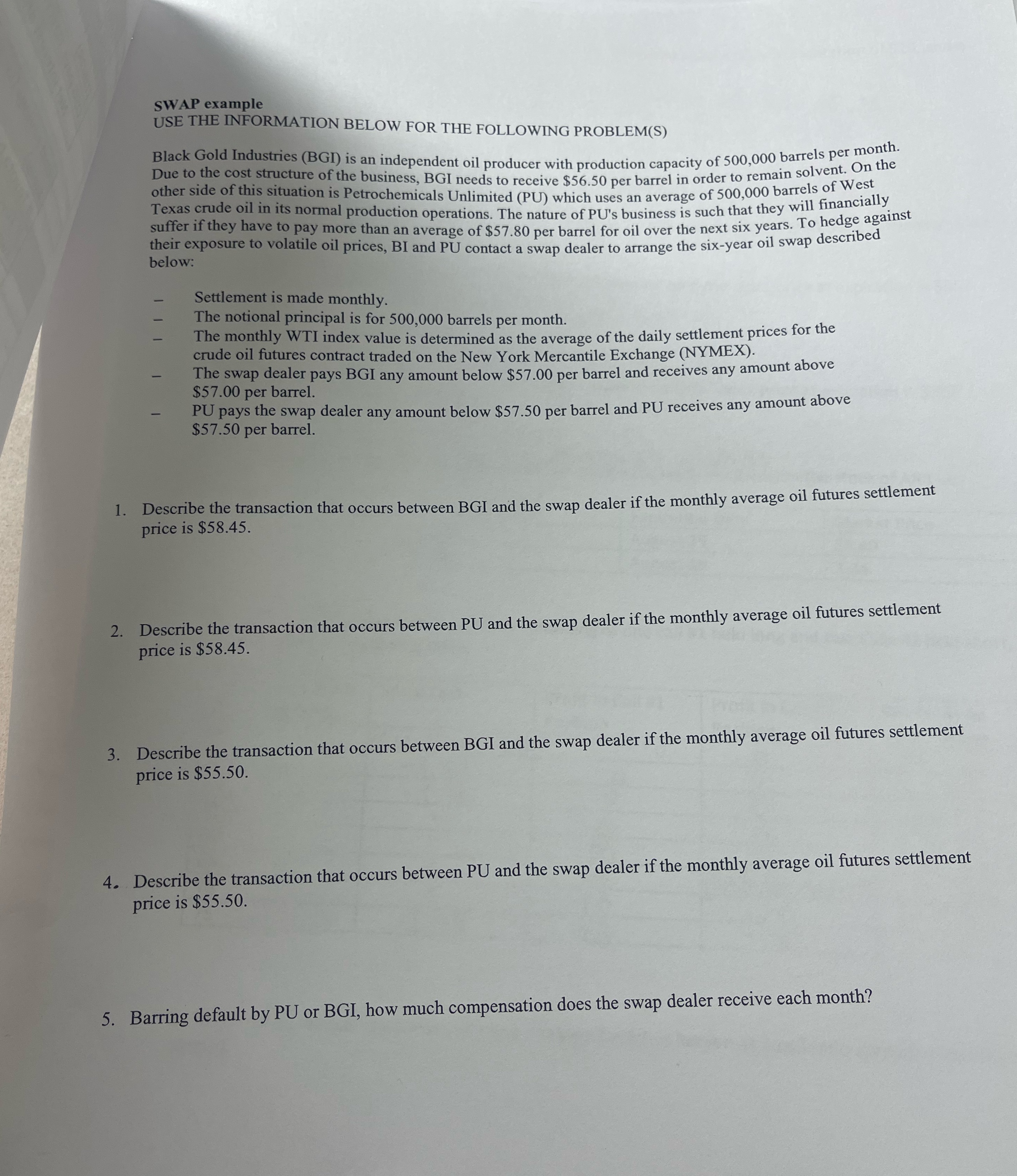

SWAP example USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) Black Gold Industries (BGI) is an independent oil producer with production capacity of 500,000 barrels per month. Due to the cost structure of the business, BGI needs to receive $56.50 per barrel in order to remain solvent. On the other side of this situation is Petrochemicals Unlimited (PU) which uses an average of 500,000 barrels of West Texas crude oil in its normal production operations. The nature of PU's business is such that they will financially suffer if they have to pay more than an average of $57.80 per barrel for oil over the next six years. To hedge against their exposure to volatile oil prices, BI and PU contact a swap dealer to arrange the six-year oil swap described below: Settlement is made monthly. The notional principal is for 500,000 barrels per month. The monthly WTI index value is determined as the average of the daily settlement prices for the crude oil futures contract traded on the New York Mercantile Exchange (NYMEX). The swap dealer pays BGI any amount below $57.00 per barrel and receives any amount above $57.00 per barrel. PU pays the swap dealer any amount below $57.50 per barrel and PU receives any amount above $57.50 per barrel. 1. Describe the transaction that occurs between BGI and the swap dealer if the monthly average oil futures settlement price is $58.45. 2. Describe the transaction that occurs between PU and the swap dealer if the monthly average oil futures settlement price is $58.45. 3. Describe the transaction that occurs between BGI and the swap dealer if the monthly average oil futures settlement price is $55.50. 4. Describe the transaction that occurs between PU and the swap dealer if the monthly average oil futures settlement price is $55.50. 5. Barring default by PU or BGI, how much compensation does the swap dealer receive each month?

Step by Step Solution

There are 3 Steps involved in it

1 Transaction between BGI and the swap dealer if the monthly average oil futures settlement price is ... View full answer

Get step-by-step solutions from verified subject matter experts