Question: System engineering with economics, probability, and statistics 4. Two alternatives are suggested for improvement to apower generation plant. Alternative A costs $60,000 and provides yearly

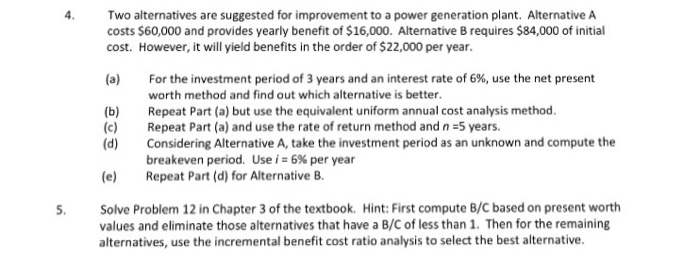

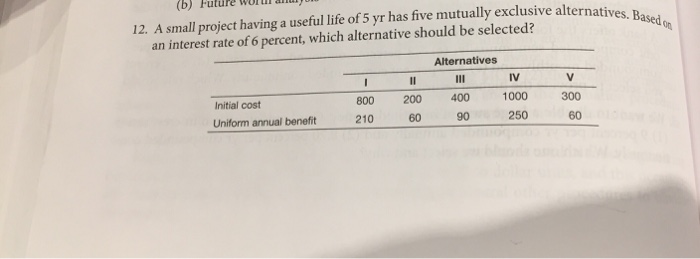

4. Two alternatives are suggested for improvement to apower generation plant. Alternative A costs $60,000 and provides yearly benefit of $16,000. Alternative B requires $84,000 of initial cost. However, it will yield benefits in the order of $22,000 per year. (a) For the investment period of 3 years and an interest rate of 6%, use the net present worth method and find out which alternative is better. (b) Repeat Part (a) but use the equivalent uniform annual cost analysis method. (c) Repeat Part (a) and usethe rate of return method and n 5 years. (d) Considering Alternative A, take the investment period as an unknown and compute the breakeven period. Use i 6% per year (e) Repeat Part (d) for Alternative B 5. Solve Problem 12 in Chapter 3 of the textbook. Hint: First compute B/C based on present worth values and eliminate those alternatives that have a B/C of less than 1. Then for the remaining alternatives, use the incremental benefit cost ratio analysis to select the best alternative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts