Question: T 213-Midterm #2 (2) (1) - Protected View - Saved to this PC . Search A A References Mailings Review View Help ernet can contain

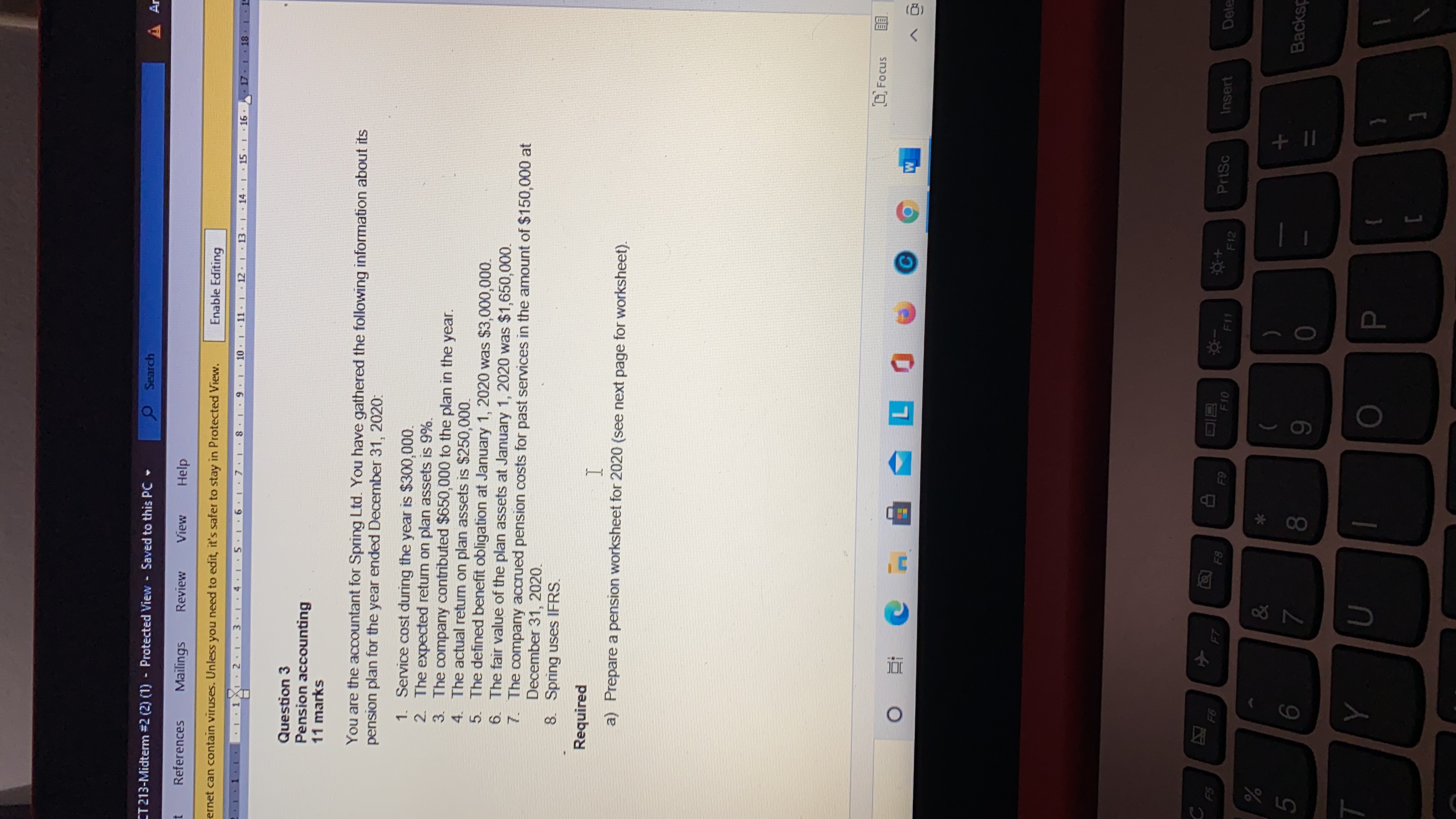

T 213-Midterm #2 (2) (1) - Protected View - Saved to this PC . Search A A References Mailings Review View Help ernet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing 1 1. . 1 1 1 . 2 . 1 3 . 1 . 4 . 1 . 5 . 1. 6 . 1 . 7 . 1 . 8 . 1 . 9 . 1 . 10 . 1 . 11 . 1 . 12 . 1 . 13 . 1 . 14 . 1 . 15 . 1 . 16 . . 17 . 1 . 18 . 1 Question 3 Pension accounting 11 marks You are the accountant for Spring Ltd. You have gathered the following information about its pension plan for the year ended December 31, 2020: 1. Service cost during the year is $300,000. 2. The expected return on plan assets is 9%. 3. The company contributed $650,000 to the plan in the year. 4. The actual return on plan assets is $250,000. 5. The defined benefit obligation at January 1, 2020 was $3,000,000. 6. The fair value of the plan assets at January 1, 2020 was $1,650,000. 7. The company accrued pension costs for past services in the amount of $150,000 at December 31, 2020. 8. Spring uses IFRS Required I a) Prepare a pension worksheet for 2020 (see next page for worksheet). Focus W ES 012 F6 FT F8 F9 F10 F11 F12 PrtSc Insert Del % & 5 6 8 Backs P

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts