Question: t Example 5.14 Investment Portfolio Risk (Linear Function Mean and Variance) Henry Chang has asked for your assistance in establishing a portfolio containing two stocks.

t

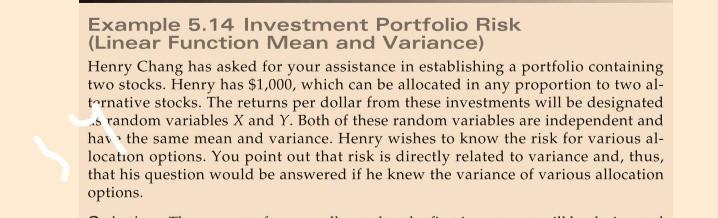

Example 5.14 Investment Portfolio Risk (Linear Function Mean and Variance) Henry Chang has asked for your assistance in establishing a portfolio containing two stocks. Henry has $1,000, which can be allocated in any proportion to two al- tornative stocks. The returns per dollar from these investments will be designated 5 random variables X and Y. Both of these random variables are independent and hav the same mean and variance. Henry wishes to know the risk for various al- location options. You point out that risk is directly related to variance and, thus, that his question would be answered if he knew the variance of various allocation optionsStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock