Question: T Instructions: Begin by completing Worksheet 1 and 2 (do not forget there are 2 worksheets in the Excel file!). You are to assume the

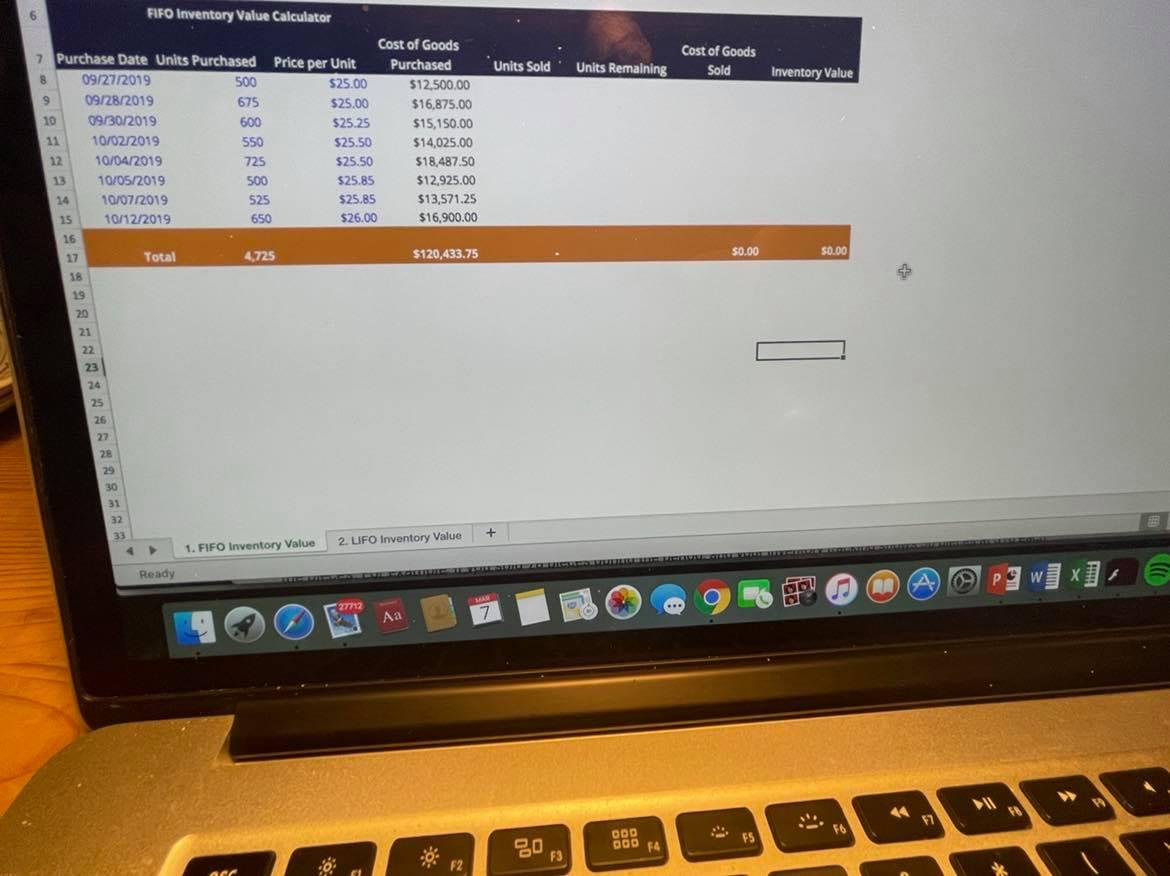

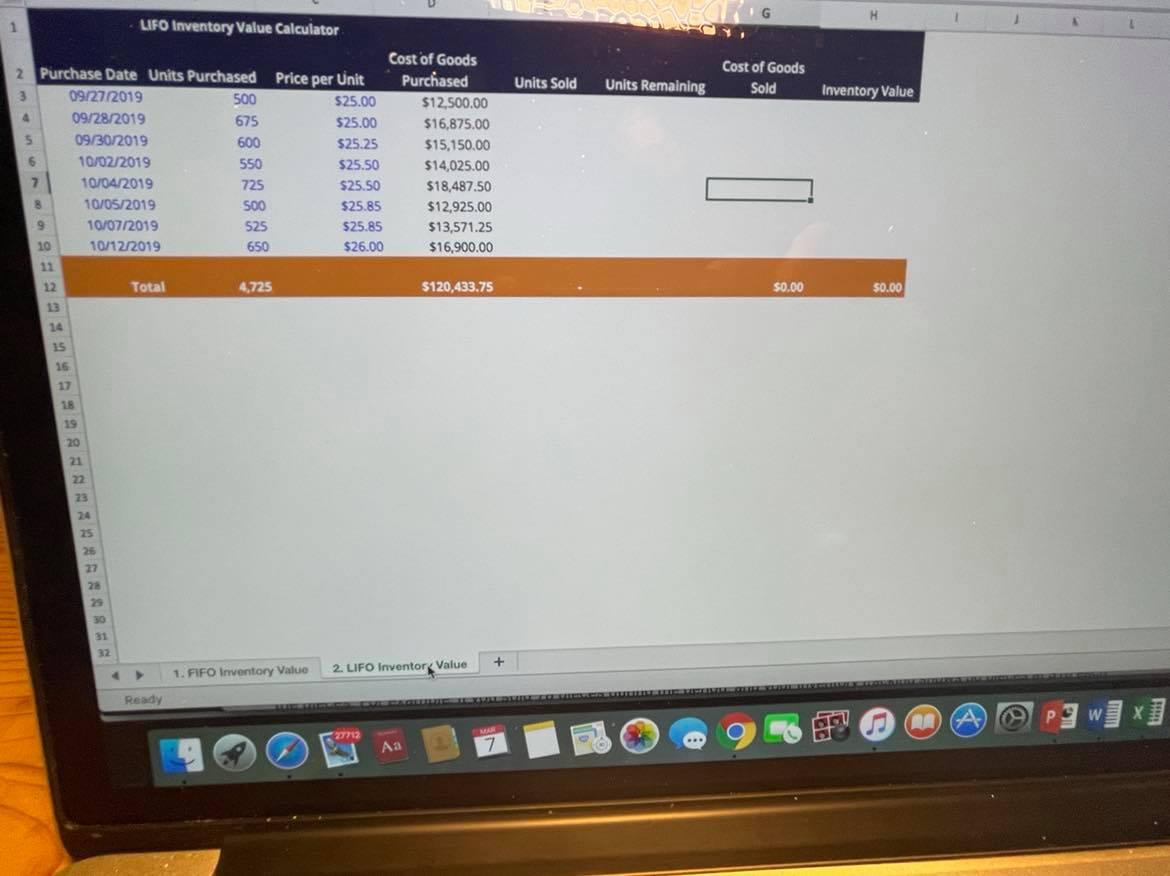

T Instructions: Begin by completing Worksheet 1 and 2 (do not forget there are 2 worksheets in the Excel file!). You are to assume the firm sells 4,200 units between 9/27/2019 and 10/12/2019. Assume this is a new firm and the inventory balance was zero prior to 9/27/2019. Use the information from the TOTAL line item (row 17) to answer the following three questions. T Please remember to save your work including your last and first name in the file title. PLEASE EXPLAIN AND JUSTIFY YOUR ANSWERS IN ORDER TO RECEIVE FULL CREDIT. I I 1. Assume the firm using the LIFO inventory accounting method. What amount would the firm- report as its LIFO reserve? T 1 2. How much less does the firm pay in taxes under the LIFO method than FIFO method? ST 3. How much less is earnings under the LIFO method than FIFO method? 6 FIFO Inventory Value Calculator Units Sold Units Remaining Cost of Goods Sold Inventory Value Cost of Goods 7 Purchase Date Units Purchased Price per Unit Purchased 8 09/27/2019 500 $25.00 $12,500.00 9 09/28/2019 675 $25.00 $16,875.00 10 09/30/2019 600 $25.25 $15,150.00 11 10/02/2019 550 $25.50 $14,025.00 12 10/04/2019 725 $25.50 $18,487.50 13 10/05/2019 500 $25.85 $12,925.00 $ 10/07/2019 $25.85 $13,571.25 15 10/12/2019 650 $26.00 $16,900.00 16 Total 4,725 $120,433.75 18 525 $0.00 $0.00 17 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 + 1. FIFO Inventory Value 2. LIFO Inventory Value Ready 27712 3 57 DDD DOO FA F3 H 1 LIFO Inventory Value Calculator Units Sold Units Remaining Cost of Goods Sold Inventory Value Cost of Goods 2 Purchase Date Units Purchased Price per Unit Purchased 3 09/27/2019 500 $25.00 $12,500.00 09/28/2019 675 $25.00 $16,875.00 5 09/30/2019 600 $25.25 $15,150.00 6 10/02/2019 550 $25.50 $14,025.00 7 10/04/2019 725 $25.50 $18,487.50 10/05/2019 500 $25.85 $12,925.00 9 10/07/2019 525 $25.85 $13,571.25 10 10/12/2019 650 $26.00 $16,900.00 12 Total 4,725 $120,433.75 $0.00 $0.00 13 14 15 16 18 19 20 23 25 25 27 2 30 31 + 1. FIFO Inventory Value 2. LIFO Inventor Value Ready pgw X Aa 7 T Instructions: Begin by completing Worksheet 1 and 2 (do not forget there are 2 worksheets in the Excel file!). You are to assume the firm sells 4,200 units between 9/27/2019 and 10/12/2019. Assume this is a new firm and the inventory balance was zero prior to 9/27/2019. Use the information from the TOTAL line item (row 17) to answer the following three questions. T Please remember to save your work including your last and first name in the file title. PLEASE EXPLAIN AND JUSTIFY YOUR ANSWERS IN ORDER TO RECEIVE FULL CREDIT. I I 1. Assume the firm using the LIFO inventory accounting method. What amount would the firm- report as its LIFO reserve? T 1 2. How much less does the firm pay in taxes under the LIFO method than FIFO method? ST 3. How much less is earnings under the LIFO method than FIFO method? 6 FIFO Inventory Value Calculator Units Sold Units Remaining Cost of Goods Sold Inventory Value Cost of Goods 7 Purchase Date Units Purchased Price per Unit Purchased 8 09/27/2019 500 $25.00 $12,500.00 9 09/28/2019 675 $25.00 $16,875.00 10 09/30/2019 600 $25.25 $15,150.00 11 10/02/2019 550 $25.50 $14,025.00 12 10/04/2019 725 $25.50 $18,487.50 13 10/05/2019 500 $25.85 $12,925.00 $ 10/07/2019 $25.85 $13,571.25 15 10/12/2019 650 $26.00 $16,900.00 16 Total 4,725 $120,433.75 18 525 $0.00 $0.00 17 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 + 1. FIFO Inventory Value 2. LIFO Inventory Value Ready 27712 3 57 DDD DOO FA F3 H 1 LIFO Inventory Value Calculator Units Sold Units Remaining Cost of Goods Sold Inventory Value Cost of Goods 2 Purchase Date Units Purchased Price per Unit Purchased 3 09/27/2019 500 $25.00 $12,500.00 09/28/2019 675 $25.00 $16,875.00 5 09/30/2019 600 $25.25 $15,150.00 6 10/02/2019 550 $25.50 $14,025.00 7 10/04/2019 725 $25.50 $18,487.50 10/05/2019 500 $25.85 $12,925.00 9 10/07/2019 525 $25.85 $13,571.25 10 10/12/2019 650 $26.00 $16,900.00 12 Total 4,725 $120,433.75 $0.00 $0.00 13 14 15 16 18 19 20 23 25 25 27 2 30 31 + 1. FIFO Inventory Value 2. LIFO Inventor Value Ready pgw X Aa 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts