Question: T u to type your answer in the box provided. You will not be able to uple u more often than not writing the answer

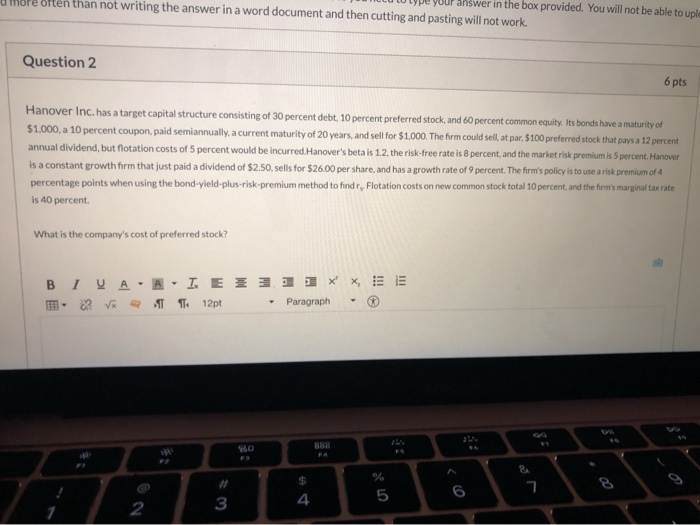

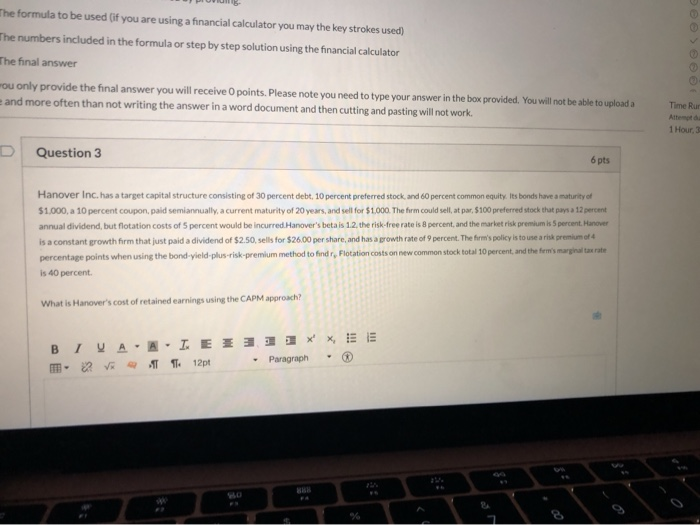

T u to type your answer in the box provided. You will not be able to uple u more often than not writing the answer in a word document and then cutting and pasting will not work. Question 2 6 pts Hanover Inc. has a target capital structure consisting of 30 percent debt. 10 percent preferred stock, and 60 percent common equity. Its bonds have a maturity of $1.000, a 10 percent coupon, paid semiannually, a current maturity of 20 years, and sell for $1,000. The firm could sell, at par, $100 preferred stock that pays a 12 percent annual dividend, but flotation costs of 5 percent would be incurred.Hanover's beta is 1.2, the risk-free rate is 8 percent, and the market risk premium is 5 percent. Hanover is a constant growth firm that just paid a dividend of $2.50, sells for $26.00 per share, and has a growth rate of 9 percent. The firm's policy is to use a risk premium of 4 percentage points when using the bond yield-plus-risk-premium method to find r, Flotation costs on new common stock total 10 percent, and the firm's marginal tax rate is 40 percent What is the company's cost of preferred stock? BIVA-A-I E 2 3 1 **, SE - V T T : 12pt - Paragraph - ovu The formula to be used (if you are using a financial calculator you may the key strokes used) The numbers included in the formula or step by step solution using the financial calculator The final answer rou only provide the final answer you will receive 0 points. Please note you need to type your answer in the box provided. You will not be able to uploada and more often than not writing the answer in a word document and then cutting and pasting will not work. Time Rur Attempt 1 Hour, 3 Question 3 6 pts Hanover Inc. has a target capital structure consisting of 30 percent debt 10 percent preferred stock and 60 percent common equity. Its bonds have a maturity $1.000, a 10 percent coupon, paid semiannually, a current maturity of 20 years, and sell for $1,000. The firm could sell, at par, $100 preferred stock that pays a 12 percent annual dividend, but flotation costs of 5 percent would be incurred.Hanover's beta is 1.2. the risk free rate is 8 percent, and the market risk premium is 5 percent. Hanover is a constant growth firm that just paid a dividend of $2.50, sells for $26.00 per share, and has a growth rate of 9 percent. The firm's policy is to use a risk premium of 4 percentage points when using the bond-yield-plus-risk-premium method to find r, Flotation costs on new common stock total 10 percent, and the firm's marginal tax rate is 40 percent What is Hanover's cost of retained earnings using the CAPM approach? BIVA-AIEE 31. XX, EE - 2 . 12pt - Paragraph

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts