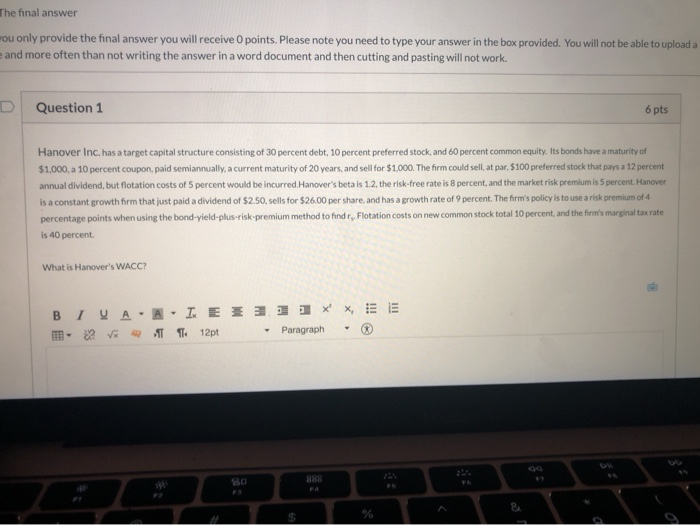

Question: The final answer wou only provide the final answer you will receive 0 points. Please note you need to type your answer in the box

The final answer wou only provide the final answer you will receive 0 points. Please note you need to type your answer in the box provided. You will not be able to upload a and more often than not writing the answer in a word document and then cutting and pasting will not work. Question 1 6 pts Hanover Inc. has a target capital structure consisting of 30 percent debt, 10 percent preferred stock, and 60 percent common equity. Its bonds have a maturity of $1,000, a 10 percent coupon, paid semiannually, a current maturity of 20 years, and sell for $1,000. The firm could sell, at par, $100 preferred stock that pays a 12 percent annual dividend, but flotation costs of 5 percent would be incurred.Hanover's beta is 1.2, the risk free rate is 8 percent, and the market risk premium is 5 percent. Hanover is a constant growth firm that just paid a dividend of $2.50, sells for $26.00 per share, and has a growth rate of 9 percent. The firm's policy is to use a risk premium of 4 percentage points when using the bond-yield-plus-riskpremium method to find r, Flotation costs on new common stock total 10 percent, and the firm's marginal tax rate is 40 percent What is Hanover's WACC? I 9 A = = = | B - A T I = T : 12pt = = = = - Paragraph 2 V S command option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts