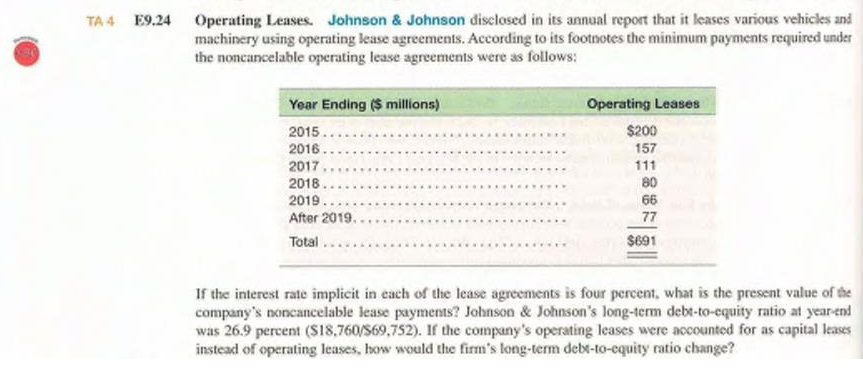

Question: TA 4 E9,24 Operating Leases. Johnson & Johnson disclosed in its annual report that it leases various vehicles and machinery using operating lease agreements. According

TA 4 E9,24 Operating Leases. Johnson & Johnson disclosed in its annual report that it leases various vehicles and machinery using operating lease agreements. According to its footnotes the minimum payments required under the noncancelable operating lease agreements were as follows: Year Ending ($ millions) 2015. 2016.. 2017., 2018.. 2019... After 2019 Total .... Operating Leases $200 157 111 80 $691 If the interest rate implicit in each of the lease agreements is four percent, what is the present value of the company's noincancelable sease payments? Johnson & Johnson's long-term debt-to-equity ratio at year-end was 26.9 percent ($18,760/S69,752). If the company's operating lcases were accounted for as capital leases instead of operating leases, how would the firm's long-term delt-to-equity ratio change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts