Question: TABLE 2: ROE AND ROA NET CASH FLOW ANALYSIS End of period Item Cash receipts Cash expenses Depreciation Interest expense Income taxes (ROE) Income taxes

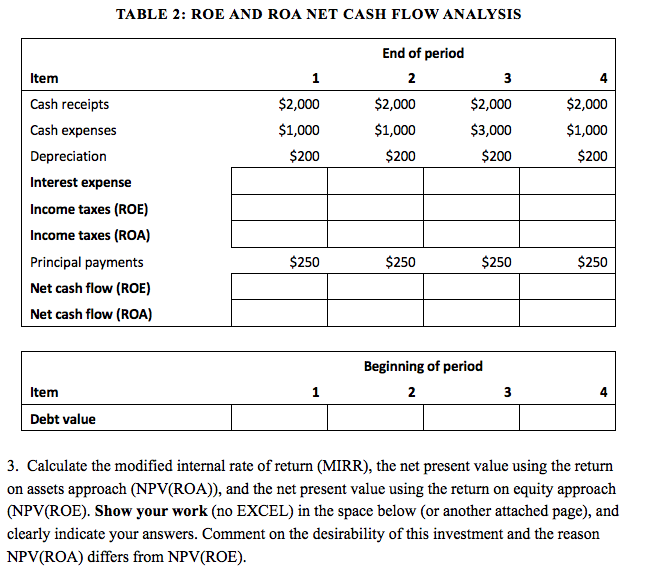

TABLE 2: ROE AND ROA NET CASH FLOW ANALYSIS End of period Item Cash receipts Cash expenses Depreciation Interest expense Income taxes (ROE) Income taxes (ROA) Principal payments Net cash flow (ROE) Net cash flow (ROA) $2,000 $1,000 $200 2 $2,000 $1,000 $200 $2,000 $3,000 $200 4 $2,000 $1,000 $200 $250 $250 $250 $250 Beginning of period Item 2 4 Debt value 3. Calculate the modified internal rate of return (MIRR), the net present value using the return on assets approach (NPV(ROA)), and the net present value using the return on equity approach (NPV(ROE). Show your work (no EXCEL) in the space below (or another attached page), and clearly indicate your answers. Comment on the desirability of this investment and the reason NPV(ROA) differs from NPV(ROE). TABLE 2: ROE AND ROA NET CASH FLOW ANALYSIS End of period Item Cash receipts Cash expenses Depreciation Interest expense Income taxes (ROE) Income taxes (ROA) Principal payments Net cash flow (ROE) Net cash flow (ROA) $2,000 $1,000 $200 2 $2,000 $1,000 $200 $2,000 $3,000 $200 4 $2,000 $1,000 $200 $250 $250 $250 $250 Beginning of period Item 2 4 Debt value 3. Calculate the modified internal rate of return (MIRR), the net present value using the return on assets approach (NPV(ROA)), and the net present value using the return on equity approach (NPV(ROE). Show your work (no EXCEL) in the space below (or another attached page), and clearly indicate your answers. Comment on the desirability of this investment and the reason NPV(ROA) differs from NPV(ROE)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts