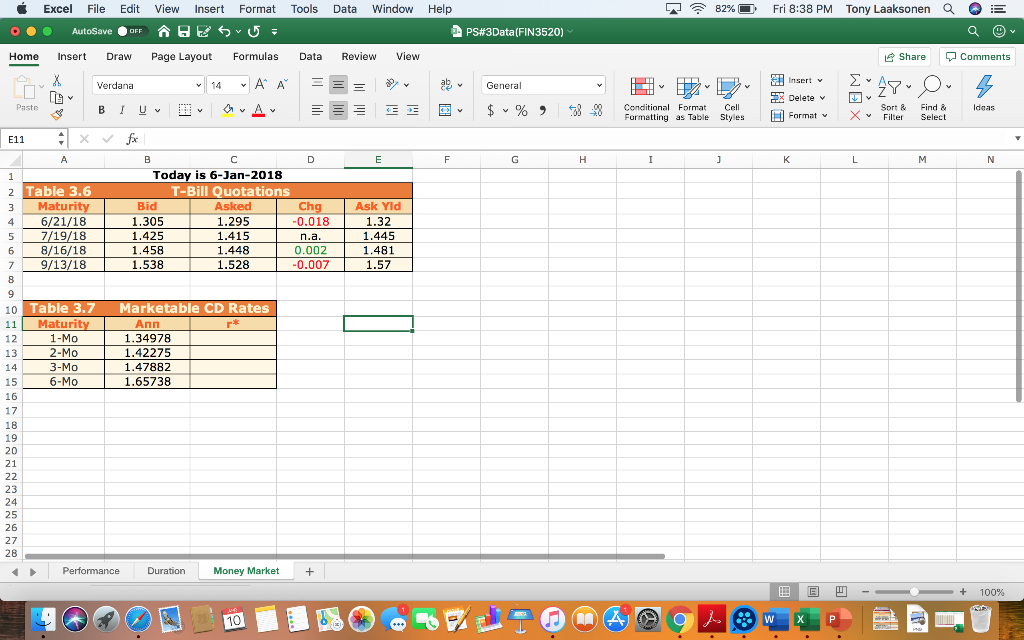

Question: Table 3 . 6 & Table 3 . 7 Today : 6 - Jan - 2018 Sixty-seven days after issuance market yields increase by 115

Table 3.6 & Table 3.7

Table 3.6 & Table 3.7

Today: 6-Jan-2018

Sixty-seven days after issuance market yields increase by 115 basis points. Show the dollar value of the 6-Month CD at that time. (1.5pts)

a) Show the general formula used to determine the value of the CD after issuance.

b) Insert the appropriate variables and solve for the value of the CD after 67 days have passed and yield increase.

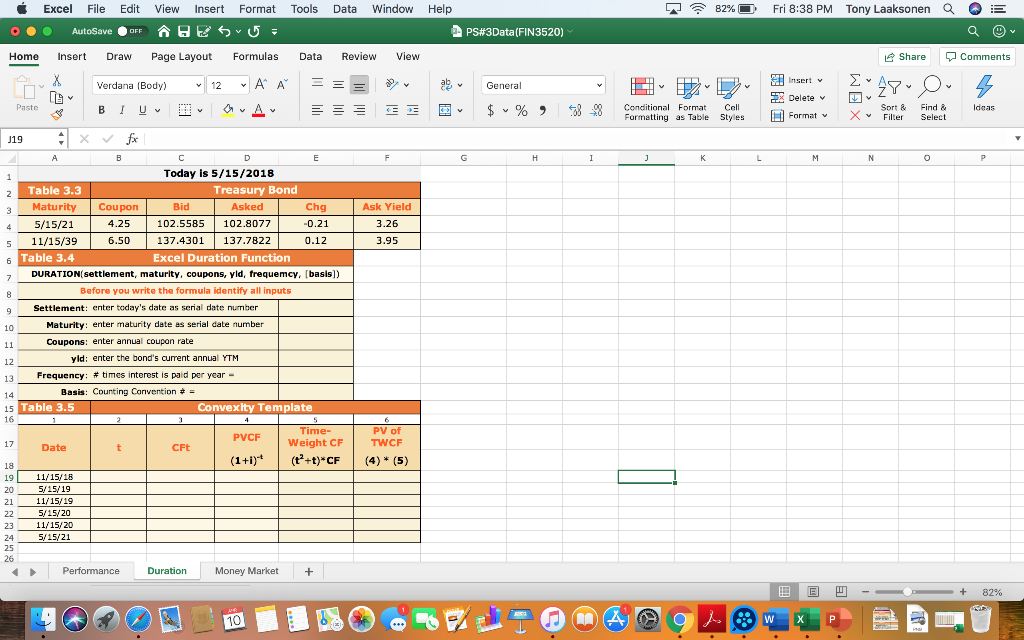

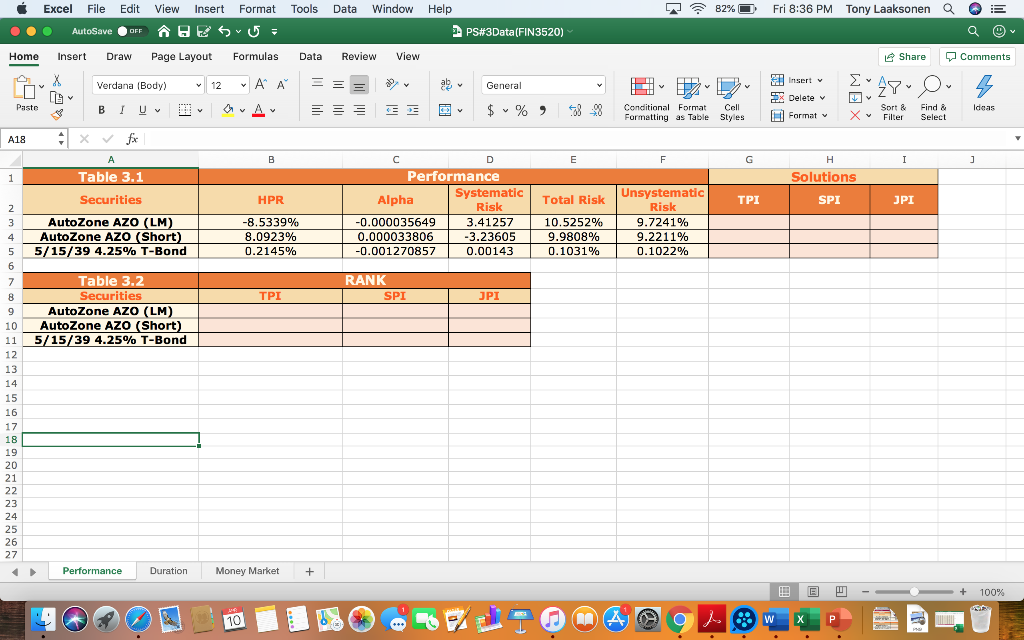

Format Tools Data Window Help 82% O Fri 8:38 PM Tony Laaksonen Q E Excel File AutoSave Edit OFF View Insert A ES O PS#3Data(FIN3520) Home View Share Comments Formulas A A A Data = Review = = Insert Draw Page Layout Verdana (Body) 12 BI U D x fx aby General $ % X Delete 28-28 Sort Filter Find & Select Ideas Formatting as Table Styles Format X V Paste 119 Ask Yield 3.26 3.95 Today is 5/15/2018 Table 3.3 Treasury Bond Maturity Coupon Bid Asked Chg 5/15/21 4.25 102.5585 102.8077 -0.21 11/15/39 6.50 137.4301 137.7822 0.12 Table 3.4 Excel Duration Function DURATION(settlement, maturity, coupons, yld, frequemcy, (basis) Before you write the formula identify all inputs Settlement: enter today's date as serial date number Maturity: enter maturity date as serial date number Coupons: enter annual coupon rate yld: enter the bond's current annual YTM Frequency: # times interest is paid per year - Basis: Counting Convention # = Table 3.5 Convexity Template 11 PVCF Date CFt Time- Weight CF (t?+t)*CF PV of TWCF (4) * (5) (1+i) 11/15/18 5/15/19 11/15/19 5/15/20 11/15/20 5/15/21 22 23 24 Performance Duration Money Market + E B - - + 82% Tools Data Window Help 82% O Fri 8:36 PM Tony Laaksonen Q E PS#3Data(FIN3520) View Excel File Edit View Insert Format .. AutoSave OFF OE U Home Insert Draw Page Layout Formulas Verdana (Body) 12 A A Paste BI U D A A18 x fx Data = Review = = Po Share E-49- O aby insert v Comments 4 General $ % EX Delete 28-28 Sort & Filter Find & Select Ideas Formatting as Table Styles Format X V Table 3.1 Solutions TPISPI Securities HPR Total Risk JPI Performance Systematic Alpha Risk -0.000035649 3.41257 0.000033806 -3.23605 -0.001270857 0.00143 AutoZone AZO (LM) AutoZone AZO (Short) 5/15/39 4.25% T-Bond -8.5339% 8.0923% 0.2145% 10.5252% 9.9808% 0.1031% Unsystematic Risk 9.7241% 9.2211% 0.1022% RANK Table 3.2 Securities AutoZone AZO (LM) AutoZone AZO (Short) 5/15/39 4.25% T-Bond 11 Performance Duration Money Market + - - + 100% Help 82% O Fri 8:38 PM Tony Laaksonen Q E PS#3Data(FIN3520) Po Share E-49- O als insert v Comments 4 General $ % 28-28 X Delete Format Ideas Formatting as Table Styles X Sort Filter Find & Select Excel File Edit View Insert Format Tools Data Window 0.0 AutoSave OFF HES U Home Insert Draw Page Layout Formulas Data Review View Verdana 14 A A = = = Paste BI U D A E11 x fx C D E Today is 6-Jan-2018 2 Table 3. 6 T -Bill Quotations Maturity Bid Asked Chg Ask Yld 6/21/18 1.305 1.295 -0.018 1.32 5 7/19/18 1.425 1.415 L n.a. | 1.445 8/16/18 1.458 1.448 0.002 1.481 9/13/18 1.538 1.528 -0.007 1.57 F G H J K L M N Table 3.7 Maturity 1-Mo 2-Mo 3-Mo 6-Mo Marketable CD Rates Ann 1.34978 1.42275 1.47882 1.65738 13 14 Performance Duration Money Market + 6 - - + 100% Format Tools Data Window Help 82% O Fri 8:38 PM Tony Laaksonen Q E Excel File AutoSave Edit OFF View Insert A ES O PS#3Data(FIN3520) Home View Share Comments Formulas A A A Data = Review = = Insert Draw Page Layout Verdana (Body) 12 BI U D x fx aby General $ % X Delete 28-28 Sort Filter Find & Select Ideas Formatting as Table Styles Format X V Paste 119 Ask Yield 3.26 3.95 Today is 5/15/2018 Table 3.3 Treasury Bond Maturity Coupon Bid Asked Chg 5/15/21 4.25 102.5585 102.8077 -0.21 11/15/39 6.50 137.4301 137.7822 0.12 Table 3.4 Excel Duration Function DURATION(settlement, maturity, coupons, yld, frequemcy, (basis) Before you write the formula identify all inputs Settlement: enter today's date as serial date number Maturity: enter maturity date as serial date number Coupons: enter annual coupon rate yld: enter the bond's current annual YTM Frequency: # times interest is paid per year - Basis: Counting Convention # = Table 3.5 Convexity Template 11 PVCF Date CFt Time- Weight CF (t?+t)*CF PV of TWCF (4) * (5) (1+i) 11/15/18 5/15/19 11/15/19 5/15/20 11/15/20 5/15/21 22 23 24 Performance Duration Money Market + E B - - + 82% Tools Data Window Help 82% O Fri 8:36 PM Tony Laaksonen Q E PS#3Data(FIN3520) View Excel File Edit View Insert Format .. AutoSave OFF OE U Home Insert Draw Page Layout Formulas Verdana (Body) 12 A A Paste BI U D A A18 x fx Data = Review = = Po Share E-49- O aby insert v Comments 4 General $ % EX Delete 28-28 Sort & Filter Find & Select Ideas Formatting as Table Styles Format X V Table 3.1 Solutions TPISPI Securities HPR Total Risk JPI Performance Systematic Alpha Risk -0.000035649 3.41257 0.000033806 -3.23605 -0.001270857 0.00143 AutoZone AZO (LM) AutoZone AZO (Short) 5/15/39 4.25% T-Bond -8.5339% 8.0923% 0.2145% 10.5252% 9.9808% 0.1031% Unsystematic Risk 9.7241% 9.2211% 0.1022% RANK Table 3.2 Securities AutoZone AZO (LM) AutoZone AZO (Short) 5/15/39 4.25% T-Bond 11 Performance Duration Money Market + - - + 100% Help 82% O Fri 8:38 PM Tony Laaksonen Q E PS#3Data(FIN3520) Po Share E-49- O als insert v Comments 4 General $ % 28-28 X Delete Format Ideas Formatting as Table Styles X Sort Filter Find & Select Excel File Edit View Insert Format Tools Data Window 0.0 AutoSave OFF HES U Home Insert Draw Page Layout Formulas Data Review View Verdana 14 A A = = = Paste BI U D A E11 x fx C D E Today is 6-Jan-2018 2 Table 3. 6 T -Bill Quotations Maturity Bid Asked Chg Ask Yld 6/21/18 1.305 1.295 -0.018 1.32 5 7/19/18 1.425 1.415 L n.a. | 1.445 8/16/18 1.458 1.448 0.002 1.481 9/13/18 1.538 1.528 -0.007 1.57 F G H J K L M N Table 3.7 Maturity 1-Mo 2-Mo 3-Mo 6-Mo Marketable CD Rates Ann 1.34978 1.42275 1.47882 1.65738 13 14 Performance Duration Money Market + 6 - - + 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts