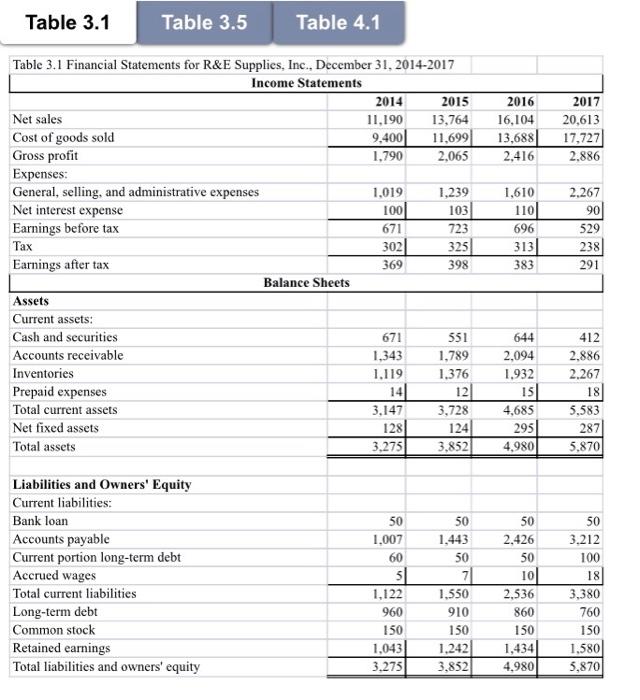

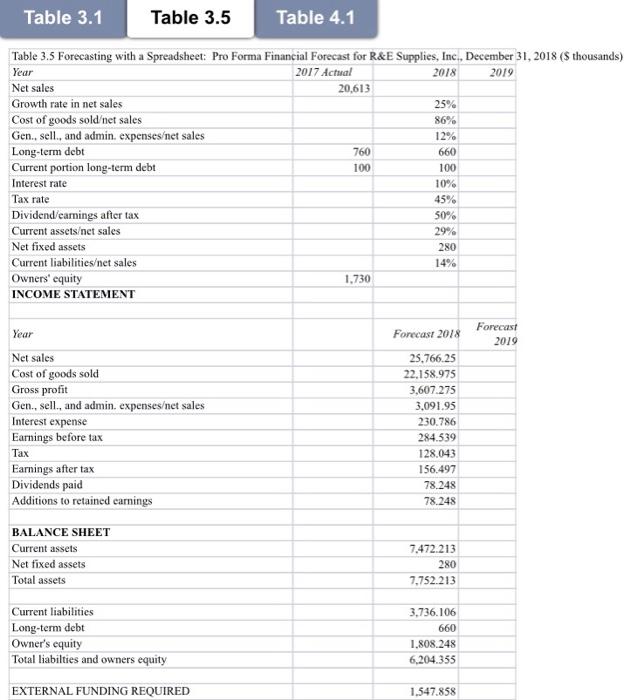

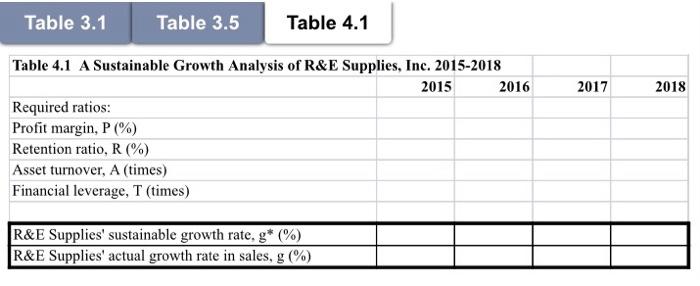

Question: Table 3.1 (financial statements), Table 3.5 (pro-forma), and Table 4.1 (sustainable growth analysis). Use the information found in sheets Table 3.1 & Table 3.5 to

Table 3.1 Table 3.5 Table 4.1 2016 16,104 13,688 2,416 2017 20,613 17,727 2.886 Table 3.1 Financial Statements for R&E Supplies, Inc., December 31, 2014-2017 Income Statements 2014 2015 Net sales 11,190 13,764 Cost of goods sold 9,400 11.6991 Gross profit 1,790 2,065 Expenses: General, selling, and administrative expenses 1,019 1,239 Net interest expense 100 103 Earnings before tax 671 723 Tax 302 325 Earnings after tax 369 398 Balance Sheets Assets Current assets: Cash and securities 671 551 Accounts receivable 1.343 1.789 Inventories 1.119 1.376 Prepaid expenses 141 12 Total current assets 3,147 3,728 Net fixed assets 128 124 Total assets 3.275 3.852 1,610 1101 696 3131 383 2.267 90 529 238 291 644 2,094 1.932 15 4,685 295 4.980 412 2.886 2.267 18 5,583 287 5,870 50 1.007 60 Liabilities and Owners' Equity Current liabilities: Bank loan Accounts payable Current portion long-term debt Accrued wages Total current liabilities Long-term debt Common stock Retained earnings Total liabilities and owners' equity 1,122 960 150 1,043 3.275 50 1,443 50 7 1.550 910 150 1.242 3,852 50 2.426 50 101 2,536 860 150 1,434 4.980 50 3.212 100 18 3,380 760 150 1,580 5,870 Table 3.1 Table 3.5 Table 4.1 Table 3.5 Forecasting with a Spreadsheet: Pro Forma Financial Forecast for R&E Supplies, Inc., December 31, 2018 (5 thousands) Year 2017 Actual 2018 2019 Net sales 20,613 Growth rate in net sales 25% Cost of goods sold'net sales 86% Gen., sell, and admin. expenseset sales 12% Long-term debt 760 660 Current portion long-term debt 100 100 Interest rate 10% Tax rate 45% Dividend/earnings after tax 50% Current assetset sales 29% Net fixed assets Current liabilitieset sales 14% Owners' equity 1.730 INCOME STATEMENT 280 Year Forecast 2018 Forecast 2019 Net sales Cost of goods sold Gross profit Gen., sell, and admin. expenseset sales Interest expense Earnings before tax Tax Earnings after tax Dividends paid Additions to retained earnings 25.766.25 22.158.975 3,607.275 3,091.95 230.786 284.539 128.043 156.497 78.248 78.248 BALANCE SHEET Current assets Net fixed assets Total assets 7.472.213 280 7,752.213 Current liabilities Long-term debt Owner's equity Total liabilties and owners equity 3,736.106 660 1.808.248 6,204.355 EXTERNAL FUNDING REQUIRED 1.547.858 Table 3.1 Table 3.5 Table 4.1 2017 2018 Table 4.1 A Sustainable Growth Analysis of R&E Supplies, Inc. 2015-2018 2015 2016 Required ratios: Profit margin, P (%) Retention ratio, R (%) Asset turnover, A (times) Financial leverage, T (times) R&E Supplies' sustainable growth rate, g* (%) R&E Supplies' actual growth rate in sales, g (%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts