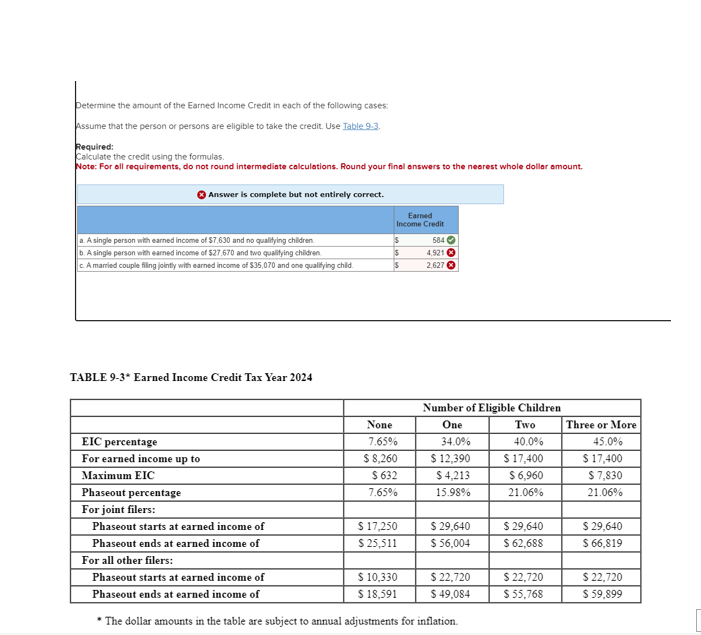

Question: TABLE 9 - 3 * Earned Income Credit Tax Year 2 0 2 4 begin { tabular } { | l | l |

TABLE Earned Income Credit Tax Year

begintabularlllll

hline & multicolumncNumber of Eligible Children

hline & None & One & Two & Three or More

hline EIC percentage & & & &

hline For earned income up to & $ & $ & $ & $

hline Maximum EIC & $ & $ & $ & $

hline Phaseout percentage & & & &

hline For joint filers: & & & &

hline Phaseout starts at earned income of & $ & $ & $ & $

hline Phaseout ends at earned income of & $ & $ & $ & $

hline For all other filers: & & & &

hline Phaseout starts at earned income of & $ & $ & $ & $

hline Phaseout ends at earned income of & $ & $ & $ & $

hline

endtabular

The dollar amounts in the table are subject to annual adjustments for inflation.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock