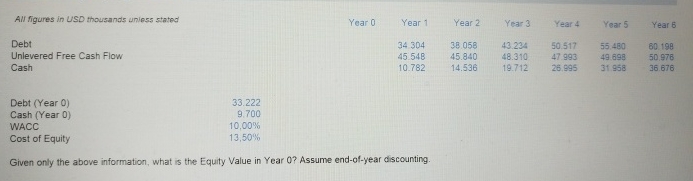

Question: table [ [ All figures in USD thousands uniess stated,,Year 0 , Year 1 , Year 2 , Year 3 , Year 4 ,

tableAll figures in USD thousands uniess stated,,Year Year Year Year Year Year Year DebtUnlevered Free Cash Flow,,,CashDebt Year Cash Year WACCCost of Equity,

Given only the above information, what is the Equity Value in Year Assume endofyear discounting.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock