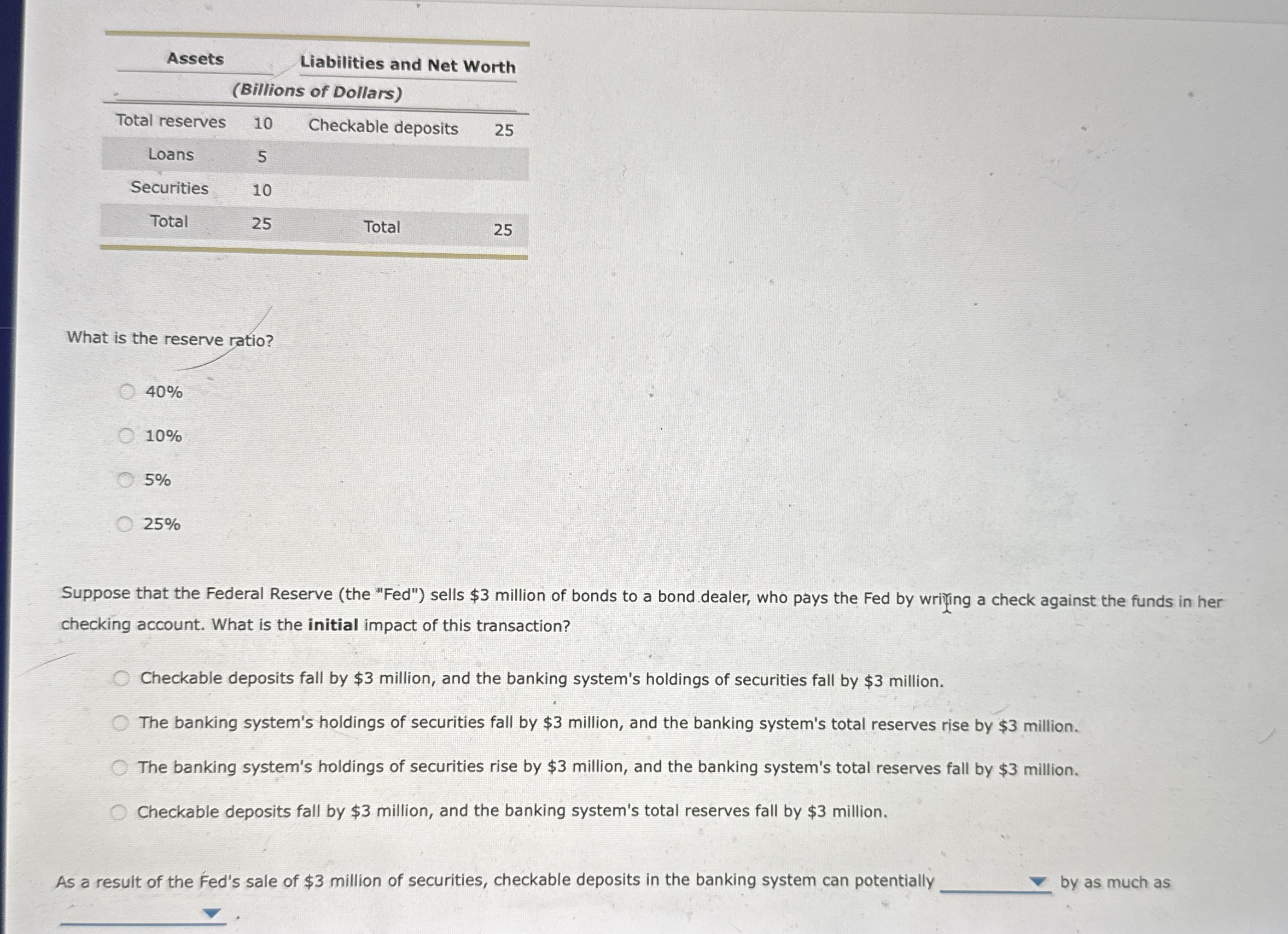

Question: table [ [ Assets , , Liabilities and Net Worth ] , [ , ( Billions of Dollars ) , , ] , [

tableAssetsLiabilities and Net WorthBillions of DollarsTotal reserves,Checkable deposits,LoansSecuritiesTotalTotal,

What is the reserve ratio?

Suppose that the Federal Reserve the "Fed" sells $ million of bonds to a bond dealer, who pays the Fed by wrifing a check against the funds in her checking account. What is the initial impact of this transaction?

Checkable deposits fall by $ million, and the banking system's holdings of securities fall by $ million.

The banking system's holdings of securities fall by $ million, and the banking system's total reserves rise by $ million.

The banking system's holdings of securities rise by $ million, and the banking system's total reserves fall by $ million.

Checkable deposits fall by $ million, and the banking system's total reserves fall by $ million.

As a result of the Fed's sale of $ million of securities checkable deposits in the banking system can potentially by as much as

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock