Question: table [ [ b , table [ [ Review the Budgetary Comparison Schedule in the RSI section of your annual report ( or

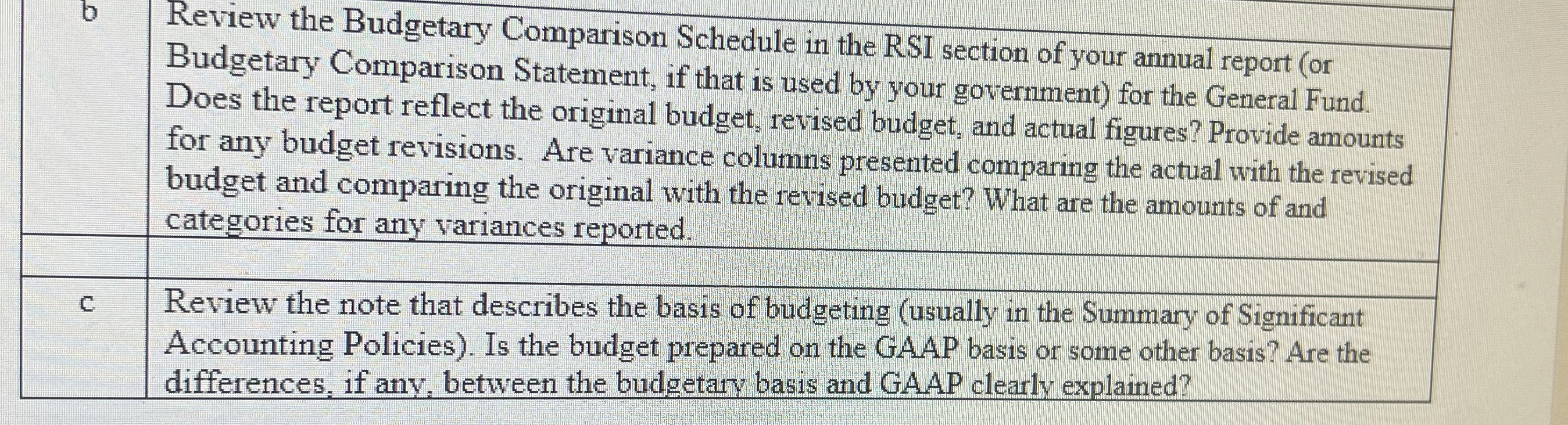

tablebtableReview the Budgetary Comparison Schedule in the RSI section of your annual report orBudgetary Comparison Statement, if that is used by your government for the General FundDoes the report reflect the original budget, revised budget, and actual figures? Provide amountsfor any budget revisions. Are variance columns presented comparing the actual with the revisedbudget and comparing the original with the revised budget? What are the amounts of andcategories for any variances reported.ctableReview the note that describes the basis of budgeting usually in the Summary of SignificantAccounting Policies Is the budget prepared on the GAAP basis or some other basis? Are thedifferences if any, between the budgetary basis and GAAP clearly explained?subject to future appropriations.

Budgets are monitored at varying levels of classification detail; however, budgetary control is legally maintained at the fund level except for the General Fund, which is maintained at the departmental level.

All budget amendments require City Commission approval. During fiscal year supplemental appropriations totaling $ million increase in the General Fund. The Special Revenue Funds budget was increased in fiscal year as follows: $ million was allocated to Departmental Improvement Initiatives, $ million was allocated to Fire Rescue Services, $ million to Miami Ballpark Parking Facilities, $ million to Police Services, $ million to Parks and Recreation Services, $ million to Planning Services, $ million to Public Art Fund, $ million to General Special Revenues, $ million to Public Works Services, $ to Public Facilities, $ to Planning and Zoning Tree Trust Fund, $ to Law Enforcement Trust Fund, $ to Historic Preservation Trust Fund, $ to Human Services, and a reduction of $ million to UASIFire Rescue, $ to Transportation and Transit, $ to Solid Waste Recycling Trust, and $ to City Clerk Services. The CRA budgets for transfers in their Special Revenue Fund Operating Budget to pay for their Special Obligation Bonds, therefore the schedule of budget to actuals is not reflected in the Required Supplementary Information.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock