Question: Table example: Please show the steps to create the proper model and the formula used in Excel. I am a bit confused on how to

Table example:  Please show the steps to create the proper model and the formula used in Excel. I am a bit confused on how to transfer the problem into this table, any help is appreciated.

Please show the steps to create the proper model and the formula used in Excel. I am a bit confused on how to transfer the problem into this table, any help is appreciated.

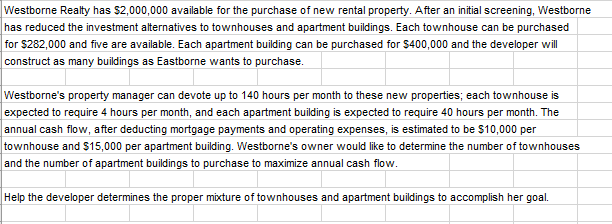

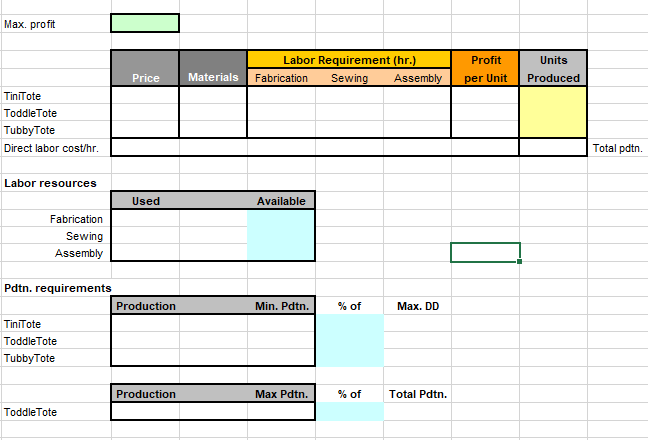

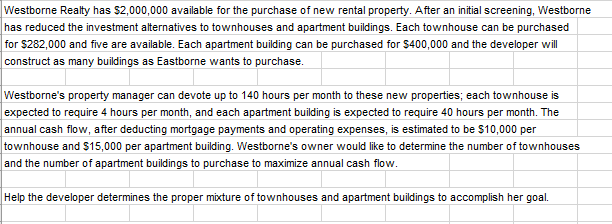

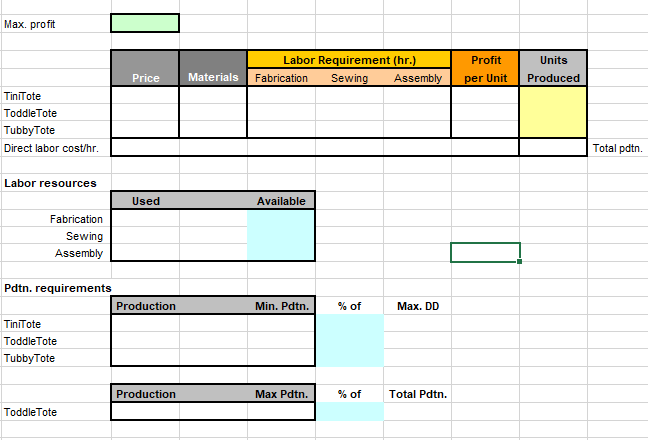

Westborne Realty has $2,000,000 available for the purchase of new rental property. After an initial screening, Westborne has reduced the investment alternatives to townhouses and apartment buildings. Each townhouse can be purchased for $282,000 and five are available. Each apartment building can be purchased for $400,000 and the developer will construct as many buildings as Eastborne wants to purchase. Westborne's property manager can devote up to 140 hours per month to these new properties; each townhouse is expected to require 4 hours per month, and each apartment building is expected to require 40 hours per month. The annual cash flow, after deducting mortgage payments and operating expenses, is estimated to be $10,000 per townhouse and $15,000 per apartment building. Westborne's owner would like to determine the number of townhouses and the number of apartment buildings to purchase to maximize annual cash flow. Help the developer determines the proper mixture of townhouses and apartment buildings to accomplish her goal. Max. profit Profit Labor Requirement (hr.) Fabrication Sewing Assembly Units Produced Price Materials per Unit TiniTote Toddle Tote TubbyTote Direct labor cost/hr. Total pdtn. Labor resources Used Available Fabrication Sewing Assembly Min. Pdtn. % of Max. DD Pdtn. requirements Production TiniTote Toddle Tote TubbyTote Production Max Pdtn. % of Total Pdtn. Toddle Tote Westborne Realty has $2,000,000 available for the purchase of new rental property. After an initial screening, Westborne has reduced the investment alternatives to townhouses and apartment buildings. Each townhouse can be purchased for $282,000 and five are available. Each apartment building can be purchased for $400,000 and the developer will construct as many buildings as Eastborne wants to purchase. Westborne's property manager can devote up to 140 hours per month to these new properties; each townhouse is expected to require 4 hours per month, and each apartment building is expected to require 40 hours per month. The annual cash flow, after deducting mortgage payments and operating expenses, is estimated to be $10,000 per townhouse and $15,000 per apartment building. Westborne's owner would like to determine the number of townhouses and the number of apartment buildings to purchase to maximize annual cash flow. Help the developer determines the proper mixture of townhouses and apartment buildings to accomplish her goal. Max. profit Profit Labor Requirement (hr.) Fabrication Sewing Assembly Units Produced Price Materials per Unit TiniTote Toddle Tote TubbyTote Direct labor cost/hr. Total pdtn. Labor resources Used Available Fabrication Sewing Assembly Min. Pdtn. % of Max. DD Pdtn. requirements Production TiniTote Toddle Tote TubbyTote Production Max Pdtn. % of Total Pdtn. Toddle Tote

Please show the steps to create the proper model and the formula used in Excel. I am a bit confused on how to transfer the problem into this table, any help is appreciated.

Please show the steps to create the proper model and the formula used in Excel. I am a bit confused on how to transfer the problem into this table, any help is appreciated.