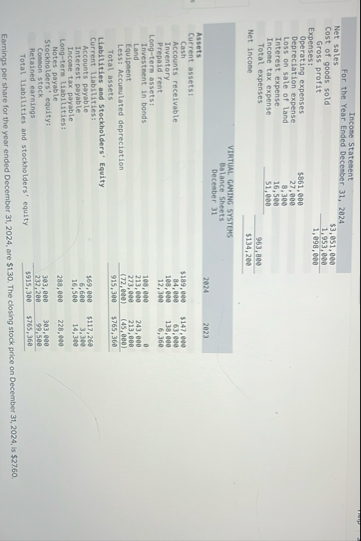

Question: table [ [ Income Statement For the Year Ended December 3 1 , 2 0 2 4 ] , [ Net sales,,$ 3 ,

tableIncome Statement For the Year Ended December Net sales,,$Cost of goods sold,,Gross profit,,Expenses:Operating expenses,$Depreciation expense,Loss on sale of land,Interest expense,Income tax expense,$Total expenses,,Net incose,,$

tableVIRTUAL GNAING SYSTEMS Balance Sheets December Cash$$Accounts receivable,eeInventoryPrepaid rent,Longtern assets:Investment in bonds,LandEquipmenteeLess: Accumulated depreciation,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock