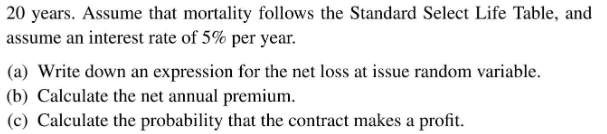

Question: Table is below Exercise 6.1 Consider a fully discrete whole life insurance with sum insured $200 000 issued to a select life aged 30. The

Table is below

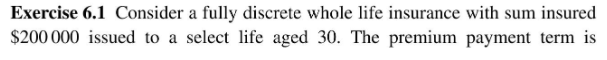

Exercise 6.1 Consider a fully discrete whole life insurance with sum insured $200 000 issued to a select life aged 30. The premium payment term is 20 years. Assume that mortality follows the Standard Select Life Table, and assume an interest rate of 5% per year. (a) Write down an expression for the net loss at issue random variable. (b) Calculate the net annual premium. (c) Calculate the probability that the contract makes a profit. SSSM A= 0.0002 B- 3E-06 - 1.124 i= 0.05 X dd(aL[x] A_[x] 2A_[x] 5E_[x] 10E_[x] 20E_[x] (1-A_[x]}/d Edda LIM] 201 19.967 0.0492 0.0058 0.7826 0.6123 0.3744 19.9673153 21 19.921 0.0514 0.0061 0.7825 0.6122 0.3743 19.9206192 22 19.872 0.0537 0.0065 0.7825 0.6122 0.3742 19.8716501 23 19.82 0.0562 0.0069 0.7825 0.6121 0.3741 19.8203026 24 19.766 0.0587 0.0073 0.7825 0.6121 0.3739 19.7664668 25 19.71 0.0614 0.0078 0.7824 0.612 0.3738 19. 7100287 26 19.651 0.06420 0.0084 0.7824 0.6119 0.3736 19.6508698 27 19.589 0.0672 0.009 0.7824 0.6119 0.3734 19.5888668 28 19.524 0.0703 0.0096 0.7823 0.6118 0.3731 19.5238921 29 19.456 0.0735 0.0103 0.7823 0.6117) 0.3729 19.4558133 30 19.384 0.0769 0.011 0.7822 0.6116 0.3726 19.3844933 31 19.31 0.0805 0.0119 0.7822 0.6114) 0.37221 19.3097905 32 19.232 0.0842 0.0128 0.7821 0.6113 0.3719 19.2315582 33 19.15 0.0881 0.0137 0.782 0.6111 0.3714 19.1496454 34 19.064 0.0922 0.0148 0.782 0.6109 0.371 19.0638963 35 18.974 0.0965 0.0159 0.7819 0.6107 0.3704 18.9741505 36 18.88 0.1009 0.0172 0.7818 0.6105 0.3699 18.8802433 37 18.782 0.1056 0.0186 0.7816 0.6102 0.3692 18.7820059 38 18.679 0.1105 0.02 0.7815 0.61 0.3684 18.6792651 39 18.572 0.1156 0.0216 0.7814 0.6096 0.3676 18.5718444 40 18.46 0.121 0.0234) 0.7812 0.6093 0.3667 18.4595635 41 18.342 0.1266 0.0253 0.781 0.6089 0.3656 18.3422392 42 18.22 0.1324 0.0273 0.7808 0.6084 0.3644 18.2196857 43 18.092 0.1385 0.0295 0.7806 0.6079 0.3631 18.0917151 44 17.958 0.14491 0.0319 0.78031 0.6073 0.3616 17.9581381 45 17.819 0.1515 0.0345 0.78 0.6066 0.36 17.8187645 46 17.673 0.1584 0.0373 0.7797 0.6059 0.3581 17.6734044 47 17.522 0.1656 0.0403 0.7793 0.6051 0.3561 17.5218686 48 17.364 0.1731 0.0436 0.7789 0.6042 0.3538 17.3639698 49 17.2 0.181 0.0471 0.7784) 0.6031 0.3512 17.1995241 50 17.028 0.1891 0.0509 0.7779 0.602 0.3483 17.0283517 51 16.85 0.1976 0.0549 0.7773 0.6007 0.3451 16.8502785 52 16.665 0.2064 0.0593 0.7767 0.5992 0.3416 16.6651378 53 16.473 0.2156 0.064 0.7759 0.5976 0.3376 16.4727716 54 16.273 0.2251 0.0691 0.7751 0.5957 0.3332 16.2730327 55 16.066 0.235| 0.0745 0.7741 0.5937 0.3283 16.0657866 56 15.851 0.2452 0.0803 0.7731 0.5913 0.3229 15.8509134 57 15.628 0.2558 0.0865 0.7719 0.58881 0.317 15.6283102 58 15.398 0.2668 0.0932 0.7706 0.5859 0.3104 15.3978936 59 15.16 0.2781 0.1003 0.7691 0.5826 0.3032 15.1596018 60 14.913 0.2898 0.1078 0.7674 0.579 0.2953 14.9133975 61 14.659 0.3019 0.1159 0.7655 0.575 0.2866 14.6592705 62 14.397 0.31441 0.1244 0.7634 0.57051 0.2772 14.3972406 631 14.127 0.3273 0.1335 0.7611 0.5655 0.267 14.12736 64 13.85 0.34051 0.1431 0.7584 0.5599 0.256 13.8497168 65 13.564 0.35411 0.1533 0.7555 0.5537 0.2441 13.5644372 66 13.272 0.368 0.1641 0.7521 0.5468 0.2314 13.2716885 67 12.972 0.3823 0.1755 0.7484 0.5392 0.218 12.9716816 68 12.665 0.3969 0.1875 0.7443 0.5307 0.2038 12.6646738 69 12.351 0.4119 0.2 0.7397 0.5213 0.1889 12.3509703 70 12.031 0.4271 0.21331 0.7345 0.5111 0.1735 12.0309267 71 11.705 0.4426 0.2271 0.7287 0.4997 0.1577| 11.7049502 72 11.374 0.4584 0.24151 0.7223 0.4872 0.1416 11.3735007 73 11.037 0.4744 0.2566 0.7151 0.47351 0.1255 11.0370913 74 10.696 0.4907| 0.2723 0.7072 0.4587 0.1095 10.6962881 751 10.352 0.5071 0.2886 0.6983 0.4425 0.094 10.3517096 76 10.004 0.5236 0.3054 0.6885|| 0.425 0.0792 10.0040248 Exercise 6.1 Consider a fully discrete whole life insurance with sum insured $200 000 issued to a select life aged 30. The premium payment term is 20 years. Assume that mortality follows the Standard Select Life Table, and assume an interest rate of 5% per year. (a) Write down an expression for the net loss at issue random variable. (b) Calculate the net annual premium. (c) Calculate the probability that the contract makes a profit. SSSM A= 0.0002 B- 3E-06 - 1.124 i= 0.05 X dd(aL[x] A_[x] 2A_[x] 5E_[x] 10E_[x] 20E_[x] (1-A_[x]}/d Edda LIM] 201 19.967 0.0492 0.0058 0.7826 0.6123 0.3744 19.9673153 21 19.921 0.0514 0.0061 0.7825 0.6122 0.3743 19.9206192 22 19.872 0.0537 0.0065 0.7825 0.6122 0.3742 19.8716501 23 19.82 0.0562 0.0069 0.7825 0.6121 0.3741 19.8203026 24 19.766 0.0587 0.0073 0.7825 0.6121 0.3739 19.7664668 25 19.71 0.0614 0.0078 0.7824 0.612 0.3738 19. 7100287 26 19.651 0.06420 0.0084 0.7824 0.6119 0.3736 19.6508698 27 19.589 0.0672 0.009 0.7824 0.6119 0.3734 19.5888668 28 19.524 0.0703 0.0096 0.7823 0.6118 0.3731 19.5238921 29 19.456 0.0735 0.0103 0.7823 0.6117) 0.3729 19.4558133 30 19.384 0.0769 0.011 0.7822 0.6116 0.3726 19.3844933 31 19.31 0.0805 0.0119 0.7822 0.6114) 0.37221 19.3097905 32 19.232 0.0842 0.0128 0.7821 0.6113 0.3719 19.2315582 33 19.15 0.0881 0.0137 0.782 0.6111 0.3714 19.1496454 34 19.064 0.0922 0.0148 0.782 0.6109 0.371 19.0638963 35 18.974 0.0965 0.0159 0.7819 0.6107 0.3704 18.9741505 36 18.88 0.1009 0.0172 0.7818 0.6105 0.3699 18.8802433 37 18.782 0.1056 0.0186 0.7816 0.6102 0.3692 18.7820059 38 18.679 0.1105 0.02 0.7815 0.61 0.3684 18.6792651 39 18.572 0.1156 0.0216 0.7814 0.6096 0.3676 18.5718444 40 18.46 0.121 0.0234) 0.7812 0.6093 0.3667 18.4595635 41 18.342 0.1266 0.0253 0.781 0.6089 0.3656 18.3422392 42 18.22 0.1324 0.0273 0.7808 0.6084 0.3644 18.2196857 43 18.092 0.1385 0.0295 0.7806 0.6079 0.3631 18.0917151 44 17.958 0.14491 0.0319 0.78031 0.6073 0.3616 17.9581381 45 17.819 0.1515 0.0345 0.78 0.6066 0.36 17.8187645 46 17.673 0.1584 0.0373 0.7797 0.6059 0.3581 17.6734044 47 17.522 0.1656 0.0403 0.7793 0.6051 0.3561 17.5218686 48 17.364 0.1731 0.0436 0.7789 0.6042 0.3538 17.3639698 49 17.2 0.181 0.0471 0.7784) 0.6031 0.3512 17.1995241 50 17.028 0.1891 0.0509 0.7779 0.602 0.3483 17.0283517 51 16.85 0.1976 0.0549 0.7773 0.6007 0.3451 16.8502785 52 16.665 0.2064 0.0593 0.7767 0.5992 0.3416 16.6651378 53 16.473 0.2156 0.064 0.7759 0.5976 0.3376 16.4727716 54 16.273 0.2251 0.0691 0.7751 0.5957 0.3332 16.2730327 55 16.066 0.235| 0.0745 0.7741 0.5937 0.3283 16.0657866 56 15.851 0.2452 0.0803 0.7731 0.5913 0.3229 15.8509134 57 15.628 0.2558 0.0865 0.7719 0.58881 0.317 15.6283102 58 15.398 0.2668 0.0932 0.7706 0.5859 0.3104 15.3978936 59 15.16 0.2781 0.1003 0.7691 0.5826 0.3032 15.1596018 60 14.913 0.2898 0.1078 0.7674 0.579 0.2953 14.9133975 61 14.659 0.3019 0.1159 0.7655 0.575 0.2866 14.6592705 62 14.397 0.31441 0.1244 0.7634 0.57051 0.2772 14.3972406 631 14.127 0.3273 0.1335 0.7611 0.5655 0.267 14.12736 64 13.85 0.34051 0.1431 0.7584 0.5599 0.256 13.8497168 65 13.564 0.35411 0.1533 0.7555 0.5537 0.2441 13.5644372 66 13.272 0.368 0.1641 0.7521 0.5468 0.2314 13.2716885 67 12.972 0.3823 0.1755 0.7484 0.5392 0.218 12.9716816 68 12.665 0.3969 0.1875 0.7443 0.5307 0.2038 12.6646738 69 12.351 0.4119 0.2 0.7397 0.5213 0.1889 12.3509703 70 12.031 0.4271 0.21331 0.7345 0.5111 0.1735 12.0309267 71 11.705 0.4426 0.2271 0.7287 0.4997 0.1577| 11.7049502 72 11.374 0.4584 0.24151 0.7223 0.4872 0.1416 11.3735007 73 11.037 0.4744 0.2566 0.7151 0.47351 0.1255 11.0370913 74 10.696 0.4907| 0.2723 0.7072 0.4587 0.1095 10.6962881 751 10.352 0.5071 0.2886 0.6983 0.4425 0.094 10.3517096 76 10.004 0.5236 0.3054 0.6885|| 0.425 0.0792 10.0040248

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts