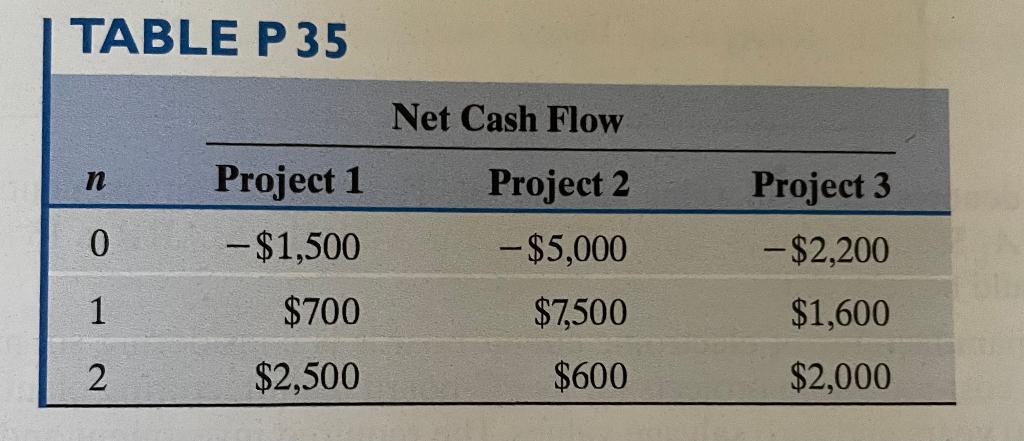

Question: TABLE P 35 Net Cash Flow n Project 2 Project 1 -$1,500 Project 3 -$2,200 0 -$5,000 $7,500 1 $700 $1,600 2 $2.500 $600 $2,000

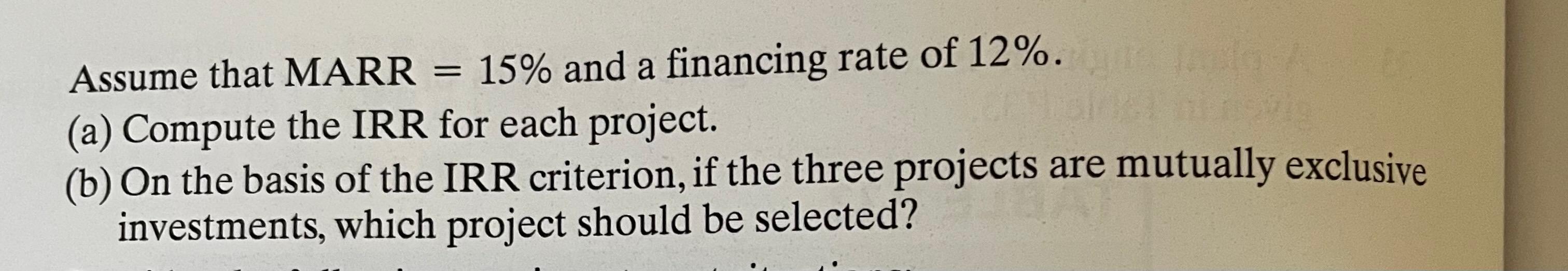

TABLE P 35 Net Cash Flow n Project 2 Project 1 -$1,500 Project 3 -$2,200 0 -$5,000 $7,500 1 $700 $1,600 2 $2.500 $600 $2,000 = Assume that MARR 15% and a financing rate of 12%. (a) Compute the IRR for each project. (b) On the basis of the IRR criterion, if the three projects are mutually exclusive investments, which project should be selected

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock